Question: Would like to know how to do P17-4. Use TMV solver and show all work and steps please! PART EIGHT Special Topics in Managerial Finance

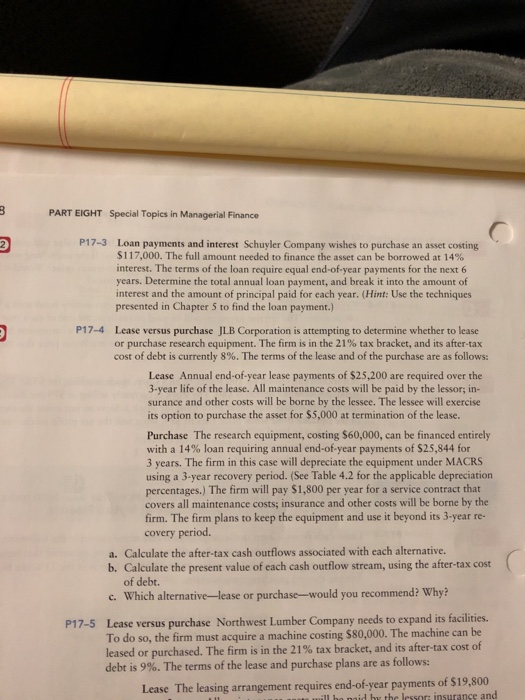

PART EIGHT Special Topics in Managerial Finance 2 P17-3 Loan payments and interest Schuyler Company wishes to purchase an asset costing $1 17,000. The full amount needed to finance the asset can be borrowed at 14% interest. The terms of the loan require equal end-of-year payments for the next 6 years. Determine the total annual loan payment, and break it into the amount of interest and the amount of principal paid for each year. (Hint: Use the techniques presented in Chapter 5 to find the loan payment.) P17-4 Lease versus purchase JLB Corporation is attempting to determine whether to lease or purchase research equipment. The firm is in the 21% tax bracket, and its after-tax cost of debt is currently 8%. The terms of the lease and of the purchase are as follows: Lease Annual end-of-year lease payments of $25,200 are required over the 3-year life of the lease. All maintenance costs will be paid by the lessor; in- surance and other costs will be borne by the lessee. The lessee will exercise its option to purchase the asset for $5,000 at termination of the lease. Purchase The research equipment, costing $60,000, can be financed entirely with a 14% loan requiring annual end-of-year payments of S25844 for 3 years. The firm in this case will depreciate the equipment under MACRS using a 3-year recovery period. (See Table 4.2 for the applicable depreciation percentages.) The firm will pay $1,800 per year for a service contract that covers all maintenance costs; insurance and other costs will be borne by the firm. The firm plans to keep the equipment and use it beyond its 3-year re- covery period. a. Calculate the after-tax cash outflows associated with each alternative. b. Calculate the present value of each cash outflow stream, using the after-tax cost of debt. c. Which alternative-lease or purchase-would you recommend? Why? P17-5 Lease versus purchase Northwest Lumber Company needs to expand its facilities. do so, the firm must acquire a machine costing $80,000. The machine can be leased or purchased. The firm is in the 21% tax bracket, and its after-tax cost of debt is 9%. The terms of the lease and purchase plans are as follows: Lease The leasing arrangement requires end-of-year payments of $19,800 Il bo peid h the lessor: insurance and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts