Question: Write a MATLAB program to compute personal Tax returns Read whether you want to compute federal tax, or state tax (1 for federal tax, 2

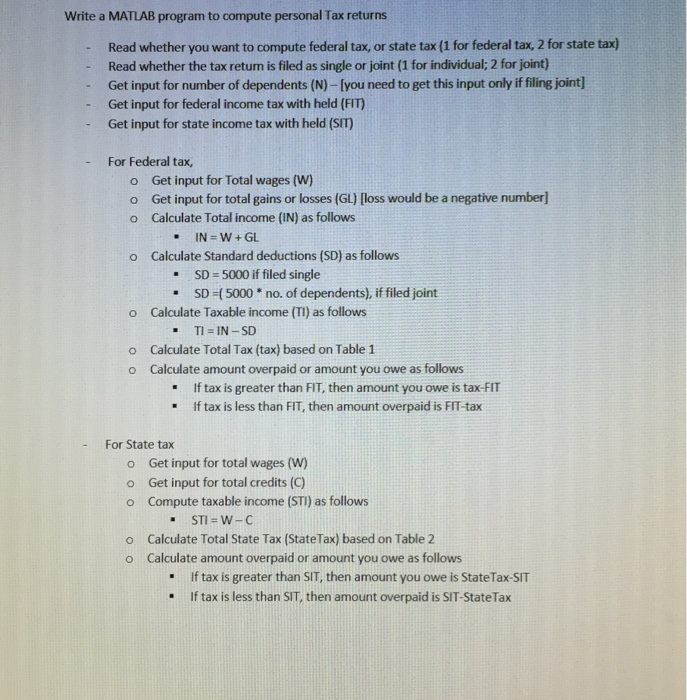

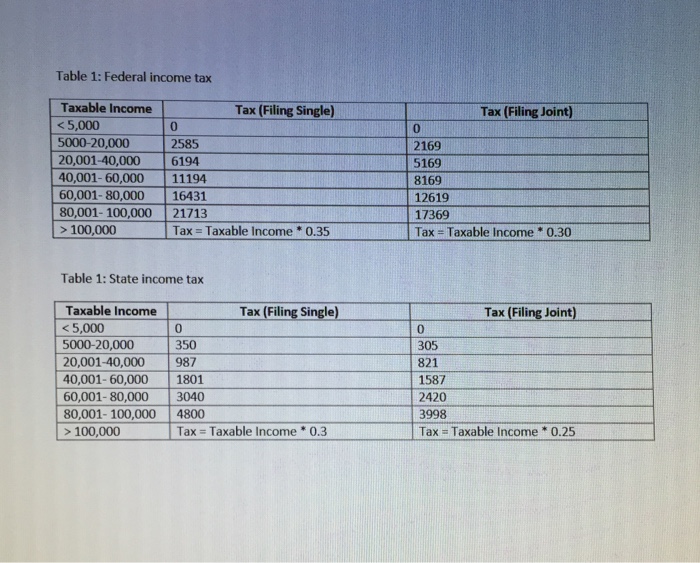

Write a MATLAB program to compute personal Tax returns Read whether you want to compute federal tax, or state tax (1 for federal tax, 2 for state tax) Read whether the tax return is filed as single or joint (1 for individual; 2 for joint) Get input for number of dependents (N)-Iyou need to get this input only if filing joint] Get input for federal income tax with held (FIT) Get input for state income tax with held (SIT) For Federal tax, o o o Get input for Total wages (W) Get input for total gains or losses (GL) [loss would be a negative number] Calculate Total income (IN) as follows o Calculate Standard deductions (SD) as follows SD 5000 if filed single - SD-(5000 no. of dependents), if filed joint o Calculate Taxable income (TI) as follows TI IN -SD Calculate Total Tax (tax) based on Table1 Calculate amount overpaid or amount you owe as follows o o If tax is greater than FIT, then amount you owe is tax-FIT If tax is less than FIT, then amount overpaid is FIT-tax - - - For State tax o o o Get input for total wages (W) Get input for total credits (C) Compute taxable income (STI) as follows Calculate Total State Tax (StateTax) based on Table 2 Calculate amount overpaid or amount you owe as follows o o " If tax is greater than SIT, then amount you owe is StateTax-SIT . If tax is less than SIT, then amount overpaid is SIT-StateTax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts