Question: [Q: 21-3998599] Written Put Option Payoffs. You have written (sold) a European put option on Ford stock with a strike price of $10. The

![[Q: 21-3998599] Written Put Option Payoffs. You have written (sold) a European](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/09/6315a5a8b594b_1662363265843.jpg)

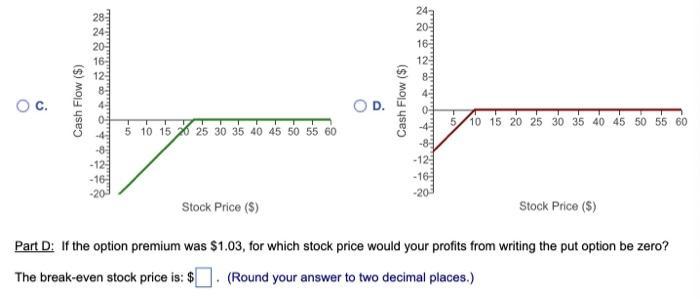

[Q: 21-3998599] Written Put Option Payoffs. You have written (sold) a European put option on Ford stock with a strike price of $10. The option will expire in exactly six months. Part A: If the stock is trading at $8 in six months, what will you owe? If the stock is trading at $8 in six months, you will owe $ (Round your answer to the nearest integer.) Part B: If the stock is trading at $23 in six months, what will you owe? If the stock is trading at $23 in six months, you will owe $. (Round your answer to the nearest integer.) Part C: Draw a diagram showing the payoff from having written the put option as a function of the stock price at expiration. Which of the four graphs best represents the payoff diagram? (Select the best choice below.) Cash Flow ($) 165 123 -8- -12- 10 15 20 25 30 35 40 45 50 55 60 Stock Price (S) O B Cash Flow ($) 20 123 -20 -5 T 10 15 20 25 30 35 40 45 50 55 60 O C. Cash Flow ($) 22842 16- 5 10 15 20 25 30 35 40 45 50 55 60 p Cash Flow ($) 243 20 16 12 -12-3 5 10 15 20 25 30 35 40 45 50 55 60 Stock Price ($) Stock Price ($) Part D: If the option premium was $1.03, for which stock price would your profits from writing the put option be zero? The break-even stock price is: $ (Round your answer to two decimal places.)

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

A put option gives a right to sell to the buyer of the put option If market ... View full answer

Get step-by-step solutions from verified subject matter experts