Question: Write an expression for the NPV for each project as a function of the discount rate. Plot the two NPV profiles (i.e., NPV as a

Write an expression for the NPV for each project as a function of the discount rate. Plot the two NPV profiles (i.e., NPV as a function of the discount rate) for the two projects on the same graph. Which project will you choose if you could choose at most one project?

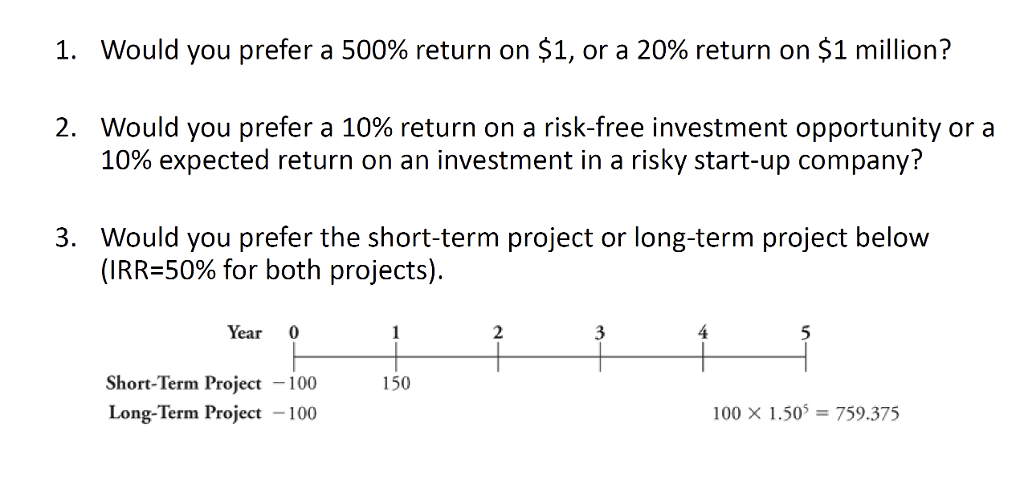

I. Would you prefer a 500% return on $1, or a 20% return on $1 million? 2. Would you prefer a 10% return on a risk-free investment opportunity or a 10% expected return on an investment in a risky start-up company? Would you prefer the short-term project or long-term project below (IRR-50% for both projects) 3. Year 0 2 Short-Term Project 100 Long-Term Project -100 150 00 X 1.505-759.375 I. Would you prefer a 500% return on $1, or a 20% return on $1 million? 2. Would you prefer a 10% return on a risk-free investment opportunity or a 10% expected return on an investment in a risky start-up company? Would you prefer the short-term project or long-term project below (IRR-50% for both projects) 3. Year 0 2 Short-Term Project 100 Long-Term Project -100 150 00 X 1.505-759.375

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts