Question: Write out this problem as a linear programme can you write down the constraints as in the example (picture) You are a financial advisor and

Write out this problem as a linear programme

can you write down the constraints as in the example (picture)

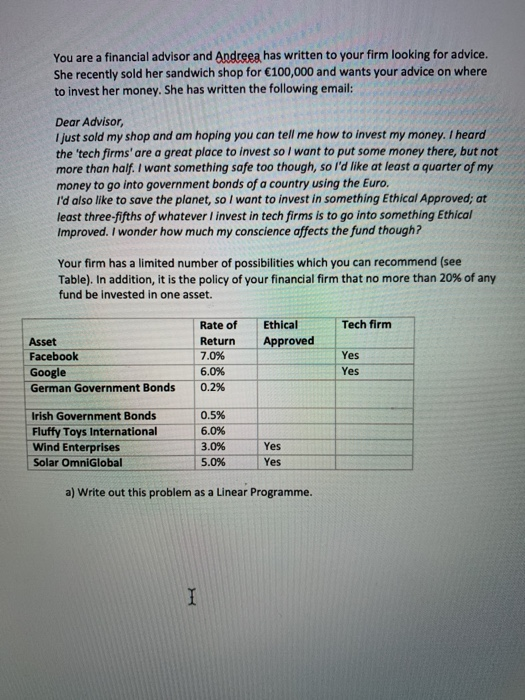

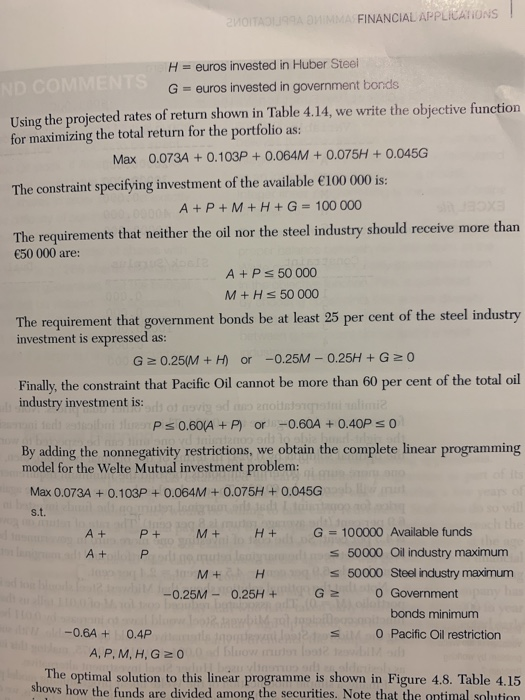

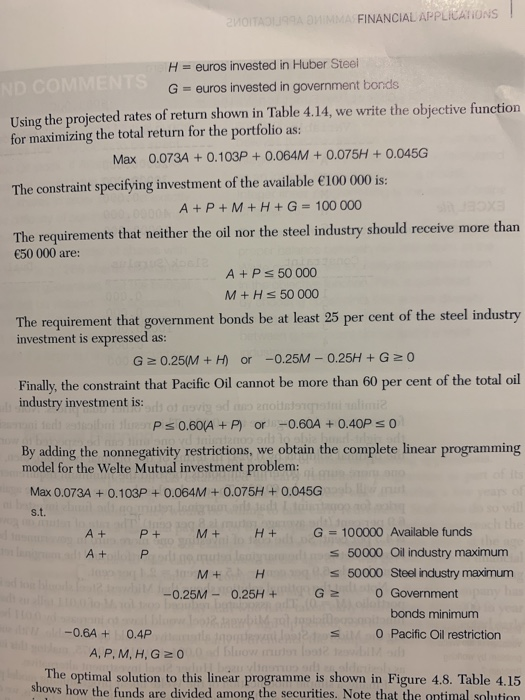

You are a financial advisor and Andreea has written to your firm looking for advice. She recently sold her sandwich shop for 100,000 and wants your advice on where to invest her money. She has written the following email: Dear Advisor, I just sold my shop and am hoping you can tell me how to invest my money. I heard the 'tech firms' are a great place to invest so I want to put some money there, but not more than half. I want something safe too though, so I'd like at least a quarter of my money to go into government bonds of a country using the Euro. I'd also like to save the planet, so I want to invest in something Ethical Approved, at least three-fifths of whatever I invest in tech firms is to go into something Ethical Improved. I wonder much my conscience affects the fund though? Your firm has a limited number of possibilities which you can recommend (see Table). In addition, it is the policy of your financial firm that no more than 20% of any fund be invested in one asset. Tech firm Ethical Approved Asset Facebook Google German Government Bonds Rate of Return 7.0% 6.0% 0.2% Yes Yes Irish Government Bonds Fluffy Toys International Wind Enterprises Solar OmniGlobal 0.5% 6.0% 3.0% 5.0% Yes Yes a) Write out this problem as a Linear Programme. I VOITOLOSAMMA FINANCIAL APPLICATIONS H = euros invested in Huber Steel ND COMMENTS = euros invested in government bonds Using the projected rates of return shown in Table 4.14, we write the objective function for maximizing the total return for the portfolio as: Max 0.0734 + 0.103P + 0.064M + 0.075H + 0.045G The constraint specifying investment of the available 100 000 is: A+P+M + H+ G = 100 000 The requirements that neither the oil nor the steel industry should receive more than 50 000 are: A + P s 50 000 M + HS 50 000 The requirement that government bonds be at least 25 per cent of the steel industry investment is expressed as: G 20.25(M + H) or -0.25M -0.25H + G 20 Finally, the constraint that Pacific Oil cannot be more than 60 per cent of the total oil industry investment is: sds of moviy od mentorini Ps 0.60(A +P) or -0.604 +0.40P = 0 By adding the nonnegativity restrictions, we obtain the complete linear programming model for the Welte Mutual investment problem: Max 0.0734 + 0.103P + 0.064M + 0.075H + 0.045G s.t. P + M + G = 100000 Available funds A+ s 50000 Oil industry maximum M + s 50000 Steel industry maximum -0.25M - 0.25H + G O Government bonds minimum -0.6A + 0.4P O Pacific Oil restriction A, P, M, H, G20 Ilurowe The optimal solution to this linear programme is shown in Figure 4.8. Table 4.15 shows how the funds are divided among the securities. Note that the antimal solution A+

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock