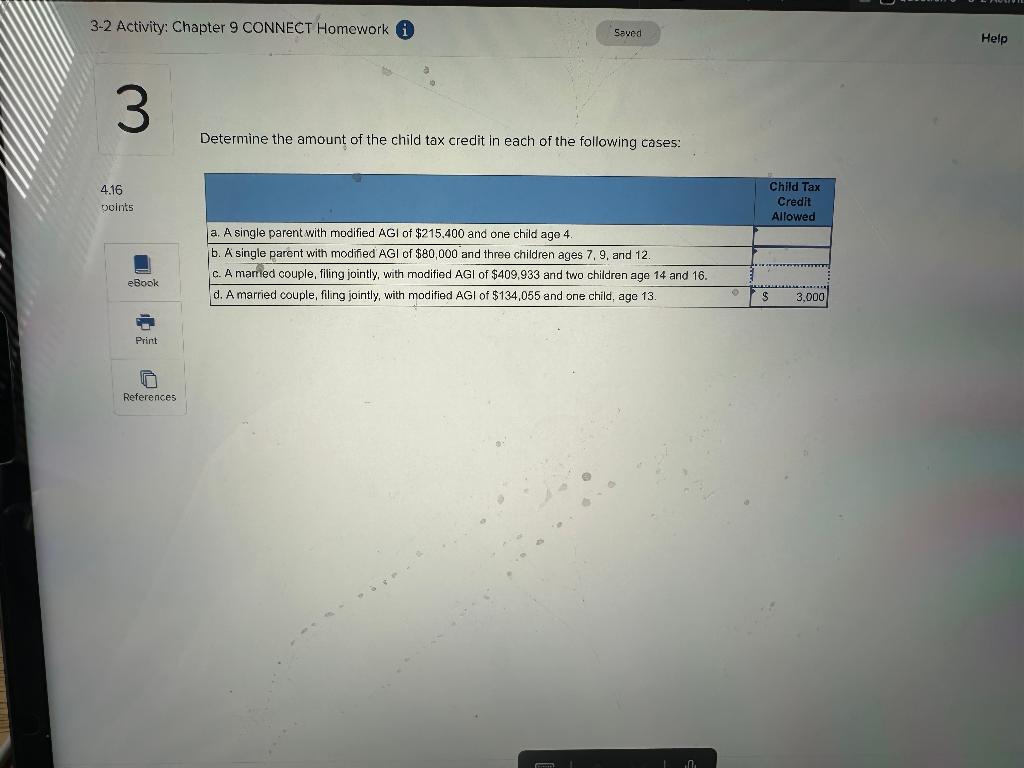

Question: Wrong answer can u please try again 3-2 Activity: Chapter 9 CONNECT Homework (i) Determine the amount of the child tax credit in each of

Wrong answer can u please try again

Wrong answer can u please try again

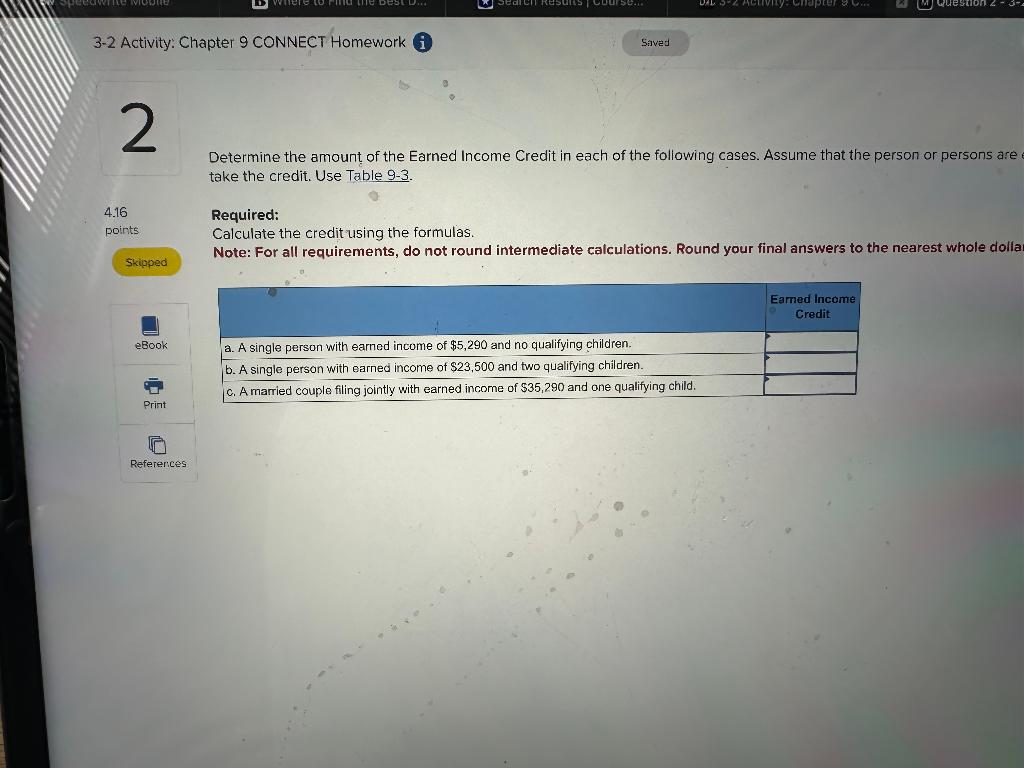

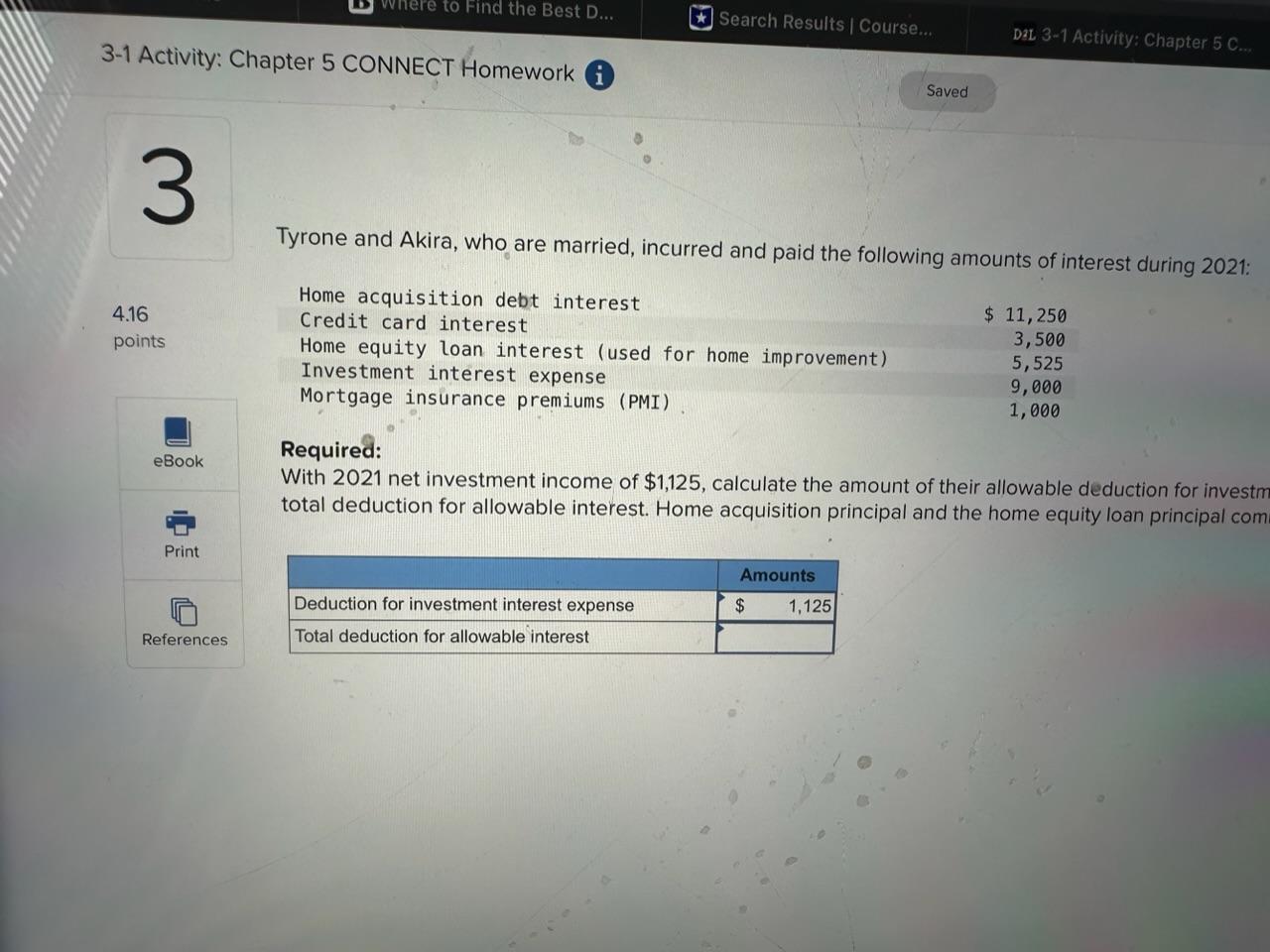

3-2 Activity: Chapter 9 CONNECT Homework (i) Determine the amount of the child tax credit in each of the following cases: Determine the amount of the Earned Income Credit in each of the following cases. Assume that the person or persons are take the credit, Use Table 9-3. Required: Calculate the credit using the formulas. Note: For all requirements, do not round intermediate calculations. Round your final answers to the nearest whole dolia Tyrone and Akira, who are married, incurred and paid the following amounts of interest during 2021: Required: With 2021 net investment income of $1,125, calculate the amount of their allowable deduction for investm total deduction for allowable interest. Home acquisition principal and the home equity loan principal com

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts