Question: X Co. is constructing a new assembly plant. A 12% construction loan for $1 million is obtained on January 1, 2021 to finance this

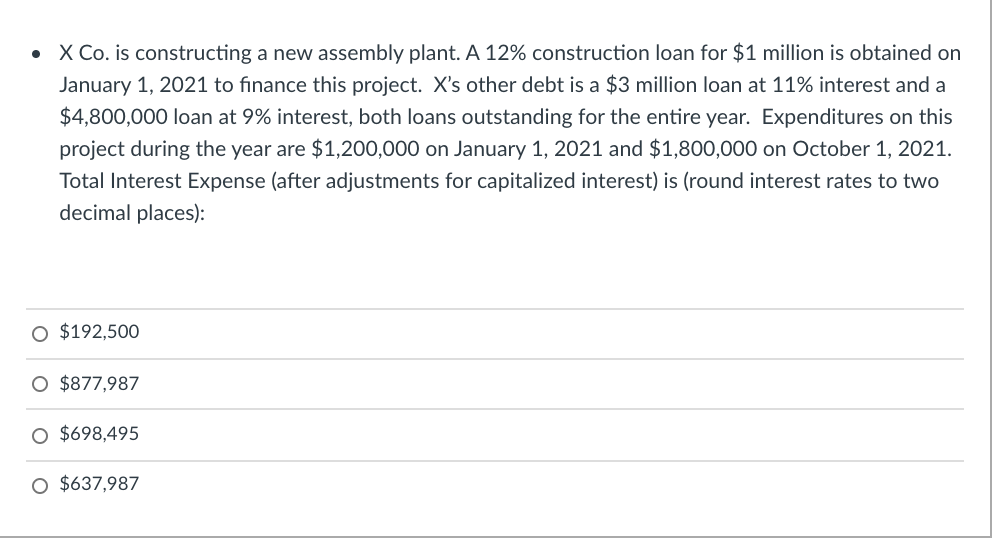

X Co. is constructing a new assembly plant. A 12% construction loan for $1 million is obtained on January 1, 2021 to finance this project. X's other debt is a $3 million loan at 11% interest and a $4,800,000 loan at 9% interest, both loans outstanding for the entire year. Expenditures on this project during the year are $1,200,000 on January 1, 2021 and $1,800,000 on October 1, 2021. Total Interest Expense (after adjustments for capitalized interest) is (round interest rates to two decimal places): O $192,500 O $877,987 $698,495 O $637,987

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Average 1 interest on other debt Total Debtx 100 Debt Rote Interest Total Interest ... View full answer

Get step-by-step solutions from verified subject matter experts