Question: X U O LL > I Z O Problem #1 - Pricing Stock Issues Your new business is doing well, but you need an additional

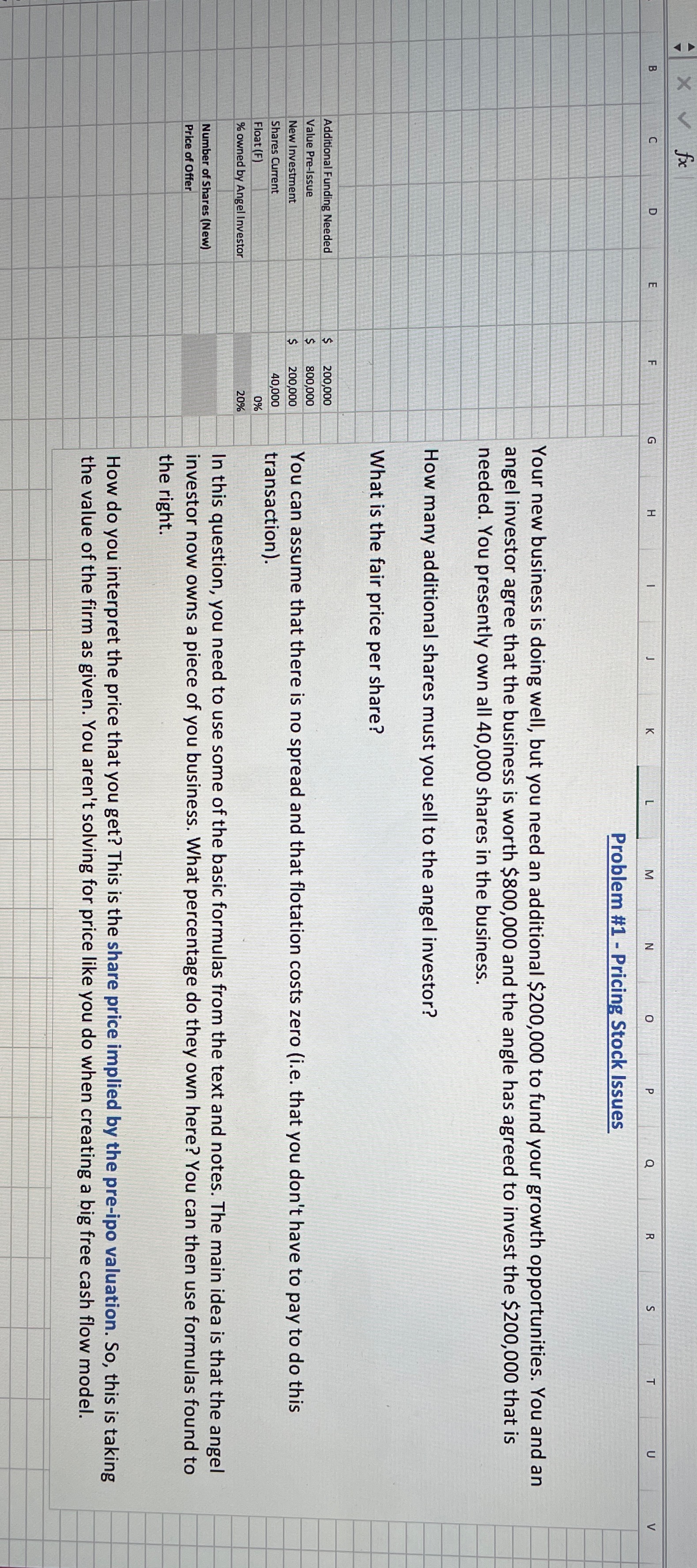

X U O LL > I Z O Problem #1 - Pricing Stock Issues Your new business is doing well, but you need an additional $200,000 to fund your growth opportunities. You and an angel investor agree that the business is worth $800,000 and the angle has agreed to invest the $200,000 that is needed. You presently own all 40,000 shares in the business. How many additional shares must you sell to the angel investor? What is the fair price per share? Additional Funding Needed 200,000 Value Pre-Issue 800,000 New Investment 200,000 You can assume that there is no spread and that flotation costs zero (i.e. that you don't have to pay to do this Shares Current 40,000 transaction). Float (F) 0% % owned by Angel Investor 20% Number of Shares (New) In this question, you need to use some of the basic formulas from the text and notes. The main idea is that the angel Price of Offer investor now owns a piece of you business. What percentage do they own here? You can then use formulas found to the right. How do you interpret the price that you get? This is the share price implied by the pre-ipo valuation. So, this is taking the value of the firm as given. You aren't solving for price like you do when creating a big free cash flow model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts