Question: XYZ develops computer products for consumers. In June 2013, a team of analysts issued a research report that valued XYZ's stock at $7.89 per share,

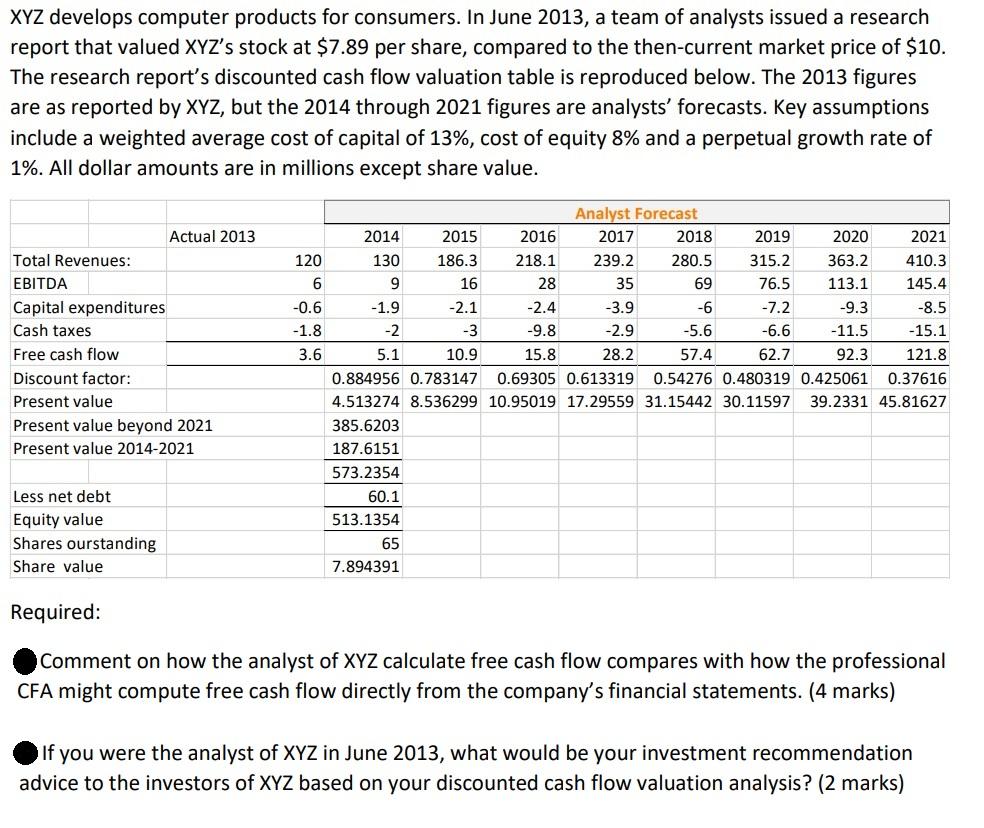

XYZ develops computer products for consumers. In June 2013, a team of analysts issued a research report that valued XYZ's stock at $7.89 per share, compared to the then-current market price of $10. The research report's discounted cash flow valuation table is reproduced below. The 2013 figures are as reported by XYZ, but the 2014 through 2021 figures are analysts' forecasts. Key assumptions include a weighted average cost of capital of 13%, cost of equity 8% and a perpetual growth rate of 1%. All dollar amounts are in millions except share value. Analyst Forecast 2017 Actual 2013 2016 2018 2019 2020 2021 2014 130 2015 186.3 Total Revenues: 120 218.1 239.2 280.5 315.2 363.2 410.3 EBITDA 6 9 16 28 35 69 76.5 113.1 145.4 Capital expenditures -0.6 -1.9 -2.1 -2.4 -3.9 -6 -7.2 -9.3 -8.5 Cash taxes -1.8 -2 -3 -9.8 -2.9 -5.6 -6.6 -11.5 -15.1 Free cash flow 3.6 5.1 10.9 15.8 28.2 57.4 62.7 92.3 121.8 Discount factor: Present value 0.884956 0.783147 0.69305 0.613319 0.54276 0.480319 0.425061 0.37616 4.513274 8.536299 10.95019 17.29559 31.15442 30.11597 39.2331 45.81627 385.6203 Present value beyond 2021 Present value 2014-2021 187.6151 573.2354 Less net debt 60.1 Equity value 513.1354 65 Shares ourstanding Share value 7.894391 Required: Comment on how the analyst of XYZ calculate free cash flow compares with how the professional CFA might compute free cash flow directly from the company's financial statements. (4 marks) If you were the analyst of XYZ in June 2013, what would be your investment recommendation advice to the investors of XYZ based on your discounted cash flow valuation analysis? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts