Question: Y8 You are evaluating two projects. You may accept only one of them. Project one will cost $379, 000 initially and will pay $134,000 each

Y8

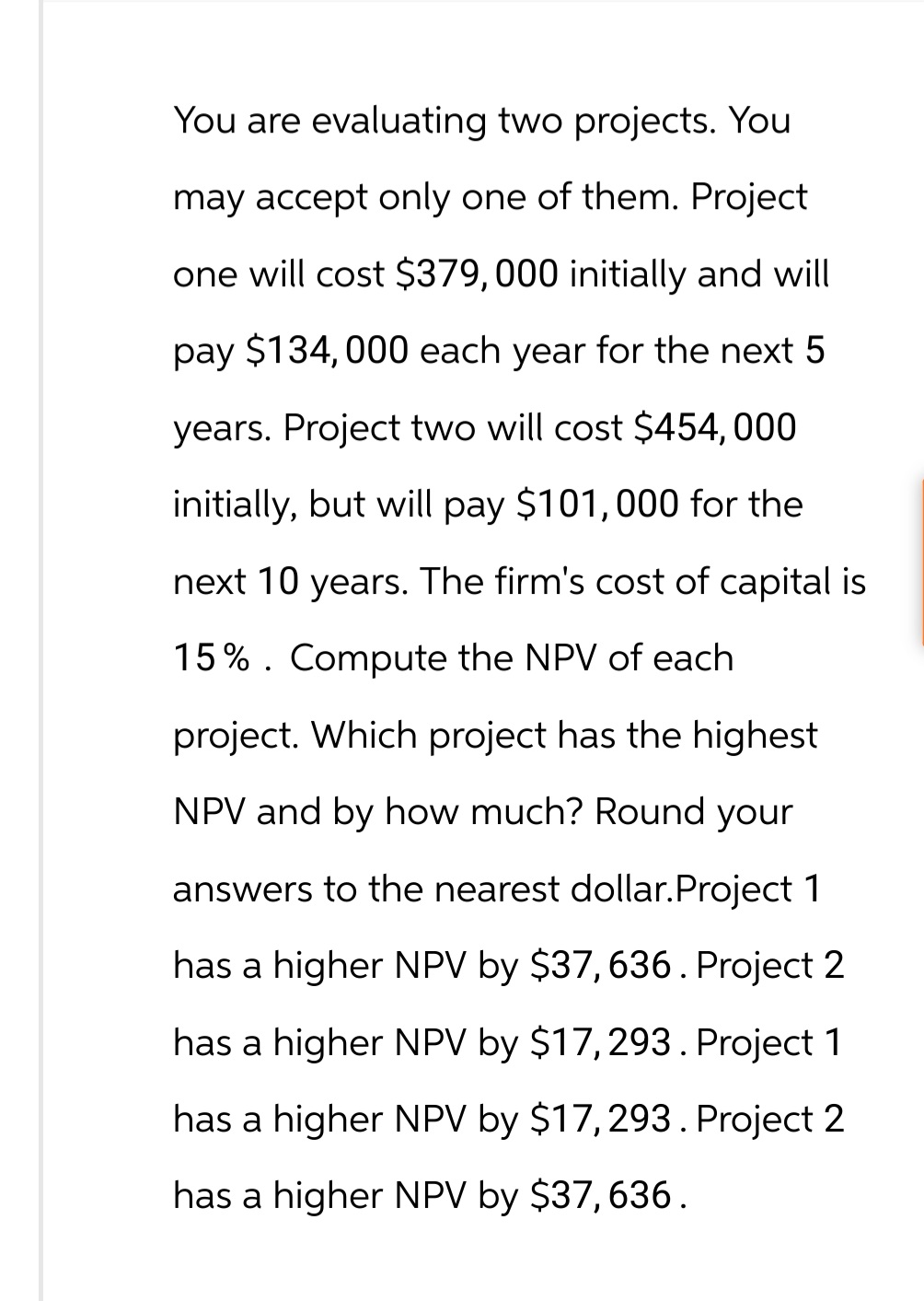

You are evaluating two projects. You may accept only one of them. Project one will cost $379, 000 initially and will pay $134,000 each year for the next 5 years. Project two will cost $454,000 initially, but will pay $101, 000 for the next 10 years. The firm's cost of capital is 15% . Compute the NPV of each project. Which project has the highest NPV and by how much? Round your answers to the nearest dollar.Project 1 has a higher NPV by $37,636 . Project 2 has a higher NPV by $17,293 . Project 1 has a higher NPV by $17,293 . Project 2 has a higher NPV by $37,636

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts