Question: Y9 Logitech is considering a project to construct a new product. The life of the project will be five years. A survey which cost $4

Y9

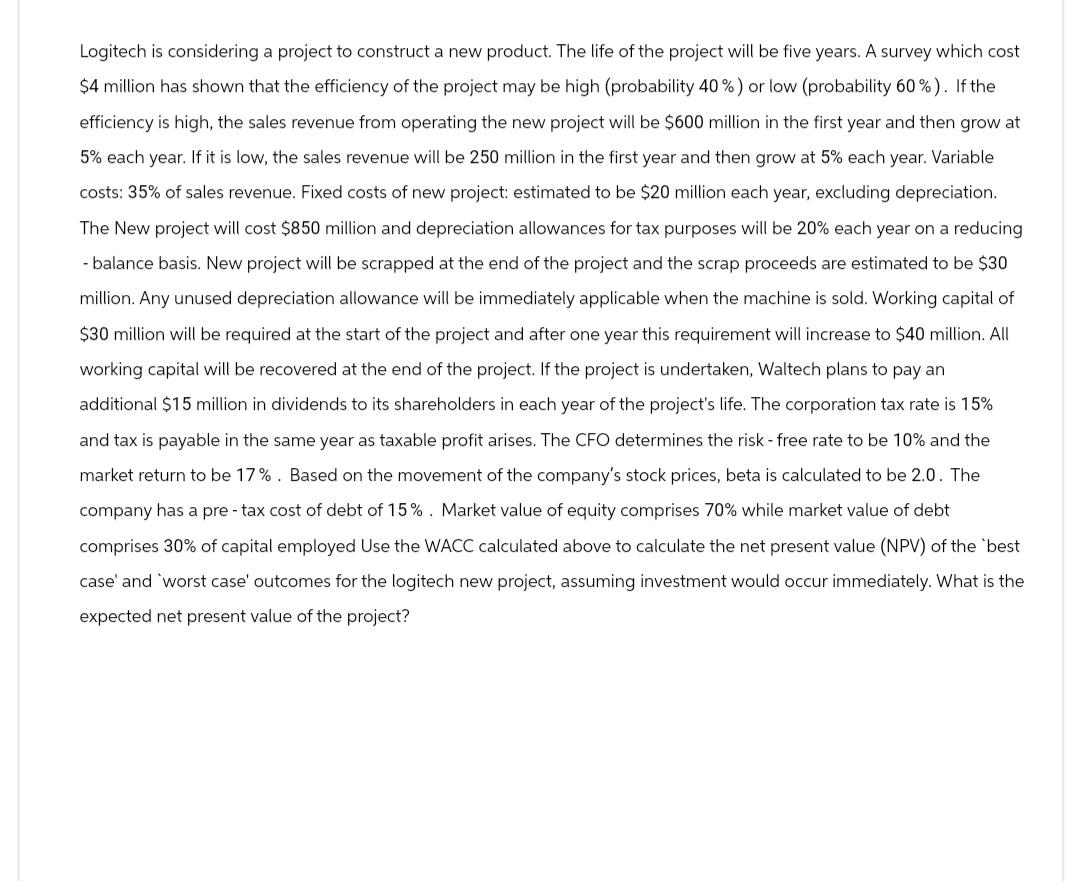

Logitech is considering a project to construct a new product. The life of the project will be five years. A survey which cost $4 million has shown that the efficiency of the project may be high (probability 40%) or low (probability 60%). If the efficiency is high, the sales revenue from operating the new project will be $600 million in the first year and then grow at 5% each year. If it is low, the sales revenue will be 250 million in the first year and then grow at 5% each year. Variable costs: 35% of sales revenue. Fixed costs of new project: estimated to be $20 million each year, excluding depreciation. The New project will cost $850 million and depreciation allowances for tax purposes will be 20% each year on a reducing - balance basis. New project will be scrapped at the end of the project and the scrap proceeds are estimated to be $30 million. Any unused depreciation allowance will be immediately applicable when the machine is sold. Working capital of $30 million will be required at the start of the project and after one year this requirement will increase to $40 million. All working capital will be recovered at the end of the project. If the project is undertaken, Waltech plans to pay an additional $15 million in dividends to its shareholders in each year of the project's life. The corporation tax rate is 15% and tax is payable in the same year as taxable profit arises. The CFO determines the risk - free rate to be 10% and the market return to be 17%. Based on the movement of the company's stock prices, beta is calculated to be 2.0. The company has a pre-tax cost of debt of 15%. Market value of equity comprises 70% while market value of debt comprises 30% of capital employed Use the WACC calculated above to calculate the net present value (NPV) of the 'best case' and 'worst case' outcomes for the logitech new project, assuming investment would occur immediately. What is the expected net present value of the project?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts