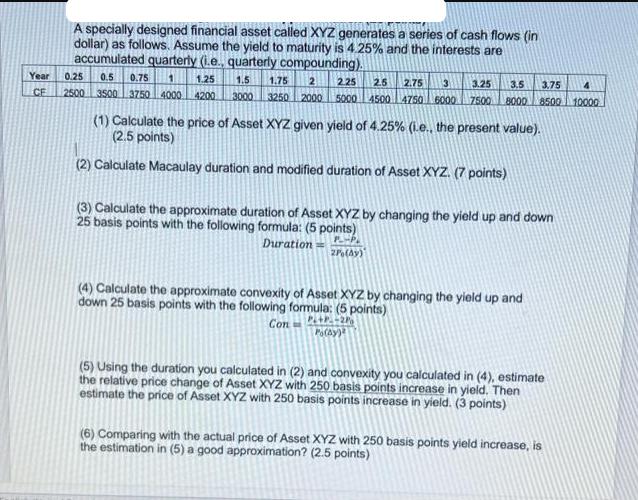

Question: Year CE A specially designed financial asset called XYZ generates a series of cash flows (in dollar) as follows. Assume the yield to maturity

Year CE A specially designed financial asset called XYZ generates a series of cash flows (in dollar) as follows. Assume the yield to maturity is 4.25% and the interests are accumulated quarterly (i.e., quarterly compounding). 0.25 0.5 0.75 1 1.25 1.5 1.75 2 2.25 2.5 2.75 3 3.25 3.5 3.75 4 2500 3500 3750 4000 4200 3000 3250 2000 5000 4500 4750 6000 7500 8000 8500 10000 (1) Calculate the price of Asset XYZ given yield of 4.25% (i.e., the present value). (2.5 points) (2) Calculate Macaulay duration and modified duration of Asset XYZ. (7 points) (3) Calculate the approximate duration of Asset XYZ by changing the yield up and down 25 basis points with the following formula: (5 points) Duration= P.-P. 2P(Ay) (4) Calculate the approximate convexity of Asset XYZ by changing the yield up and down 25 basis points with the following formula: (5 points) Con PL+P.-2P Po(Ay) (5) Using the duration you calculated in (2) and convexity you calculated in (4), estimate the relative price change of Asset XYZ with 250 basis points increase in yield. Then estimate the price of Asset XYZ with 250 basis points increase in yield. (3 points) (6) Comparing with the actual price of Asset XYZ with 250 basis points yield increase, is the estimation in (5) a good approximation? (2.5 points)

Step by Step Solution

There are 3 Steps involved in it

Here are the steps to solve this problem 1 Calculate the price of Asset XYZ given yield of 425 ie th... View full answer

Get step-by-step solutions from verified subject matter experts