Question: Yello Bus Lines uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1, 2017, at a cost of $263,569. Over

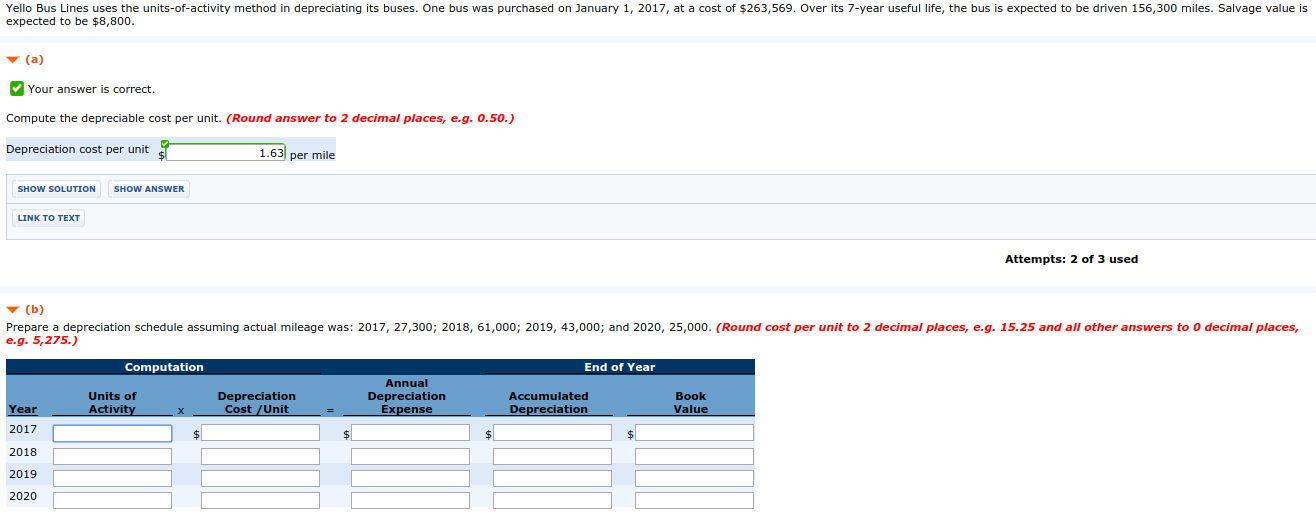

Yello Bus Lines uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1, 2017, at a cost of $263,569. Over its 7-year useful life, the bus is expected to be driven 156,300 miles. Salvage value is expected to be $8,800.

Prepare a depreciation schedule assuming actual mileage was: 2017, 27,300; 2018, 61,000; 2019, 43,000; and 2020, 25,000. (Round cost per unit to 2 decimal places, e.g. 15.25 and all other answers to 0 decimal places, e.g. 5,275.)

| Depreciation cost per unit | $ per mile |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts