Question: yes excel is fine Using the data in the following table, consider a portfolio that maintains a 50% weight on stock A and a 50%

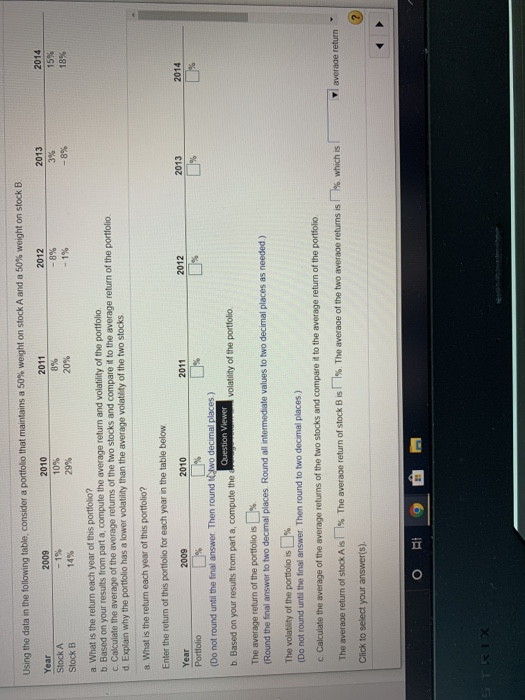

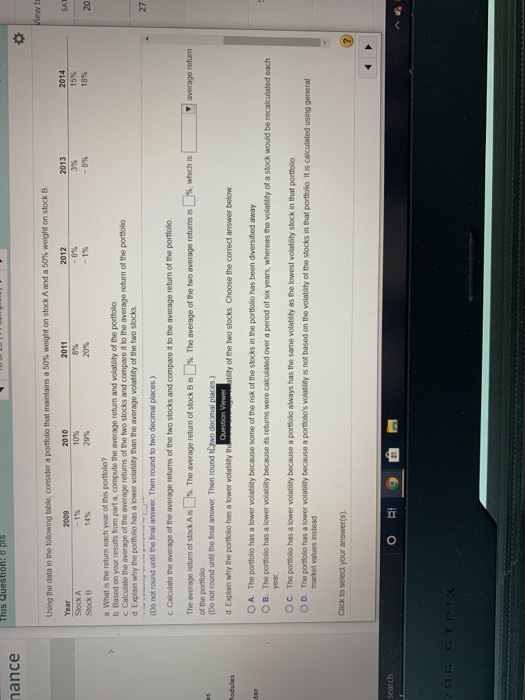

Using the data in the following table, consider a portfolio that maintains a 50% weight on stock A and a 50% weight on stock B. Year Stock A Stock B 2009 - 19 14% 2010 10% 29% 2011 8% 20% 2012 -8% - 1% 2013 3% -8% 2014 15% 18% 2014 a. What is the return each year of this portfolio? b. Based on your results from part a, compute the average return and volatility of the portfolio c. Calculate the average of the average returns of the two stocks and compare it to the average return of the portfolio d Explain why the portfolio has a lower volatility than the average volatility of the two stocks a What is the return each year of this portfolio? Enter the return of this portfolio for each year in the table below Year 2009 2010 2011 2012 2013 Portfolio (Do not round until the final answer. Then round two decimal places.) Question Viewer b. Based on your results from part a, compute the .. volatility of the portfolio The average return of the portfolio is % (Round the final answer to two decimal places. Round all intermediate values to two decimal places as needed.) The volatility of the portfolio is % (Do not round until the final answer. Then round to two decimal places) c. Calculate the average of the average returns of the two stocks and compare it to the average return of the portfolio The average return of stock Ais 1% The averace return of stock Bis%. The average of the two average retums is % which is Yl average return Click to select your answer(s). ORI X This Question: 8 pts nance View b Using the data in the following table, consider a portfolio that maintains a 50% weight on stock A and a 50% weight on stock B. 2013 3% SAT 2014 15% 18% 20 Year 2009 2010 2011 2012 StockA 10% Stock B 29% 20% - 1% a What is the return each year of this portfolio? b. Based on your results from part a, compute the average return and volatility of the portfolio c. Calculate the average of the average returns of the two stocks and compare it to the average return of the portfolio d. Explain why the portfolo has a lower volatility than the average volatility of the two stocks 27 (Do not round until the final answer. Then round to two decimal places) c. Calculate the average of the average retums of the two stocks and compare it to the average return of the portfolio The average return of stock Ais % The average return of stock B is % The average of the two average returns is % which is of the portfolio (Do not round until the final answer. Then round wo decimal places) d Explain why the portfolio has a lower volatility the Question Viewer wality of the two stocks. Choose the correct answer below average return es Modules tor O A The portfolio has a lower volatility because some of the risk of the stocks in the portfolio has been diversified away. OB. The portfolio has a lower volatility because its returns were calculated over a period of six years, whereas the volatility of a stock would be recalculated each year OC. The portfolio has a lower volatility because a portfolio always has the same volatility as the lowest volatility stock in that portfolio OD. The portfolio has a lower volatility because a portfolio's volatility is not based on the volatility of the stocks in that portfolio It is calculated using general market values instead Click to select your answer(s). search RI OBETTO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts