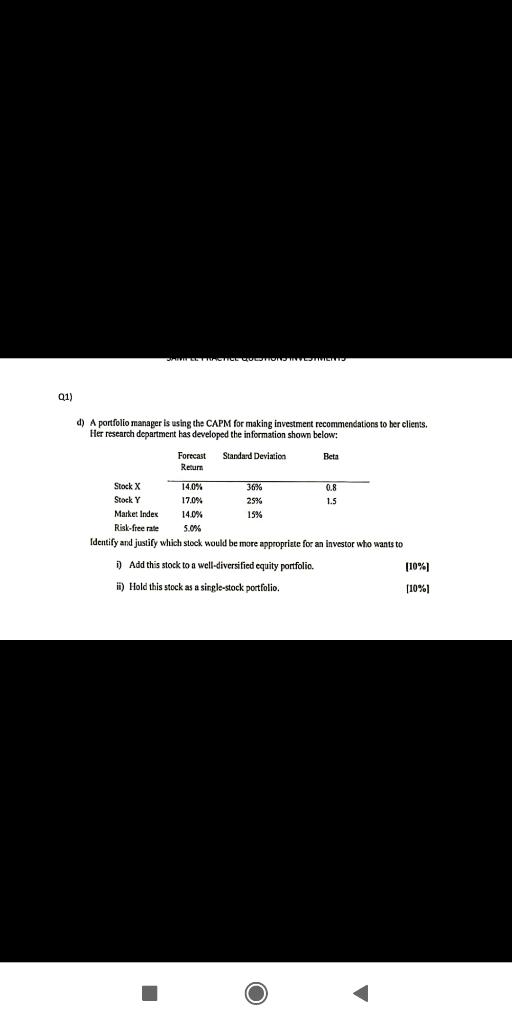

Question: VRSCURONOVICI 91) d) A portfolio manager is using the CAPM for making investment recommendations to her clients, Her research department has developed the information shown

VRSCURONOVICI 91) d) A portfolio manager is using the CAPM for making investment recommendations to her clients, Her research department has developed the information shown below: Forecast Standard Deviation Beta Return ) Stock X 14.0% 36% 0.8 Stock Y 17.0% 25% 1.5 Market Index 14.0% 15% Risk-free rate 5.0% Identify and justify which stock would be more appropriate for an investor who wants to 1) Add this stock to a well-diversified equity portfolio. (10%) i) Hold this stock as a single-stock portfolio. [10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts