Question: You are (again) asked to evaluate a new tractor project for Deere. The engineers and marketing and accounting folks have pooled their efforts to generate

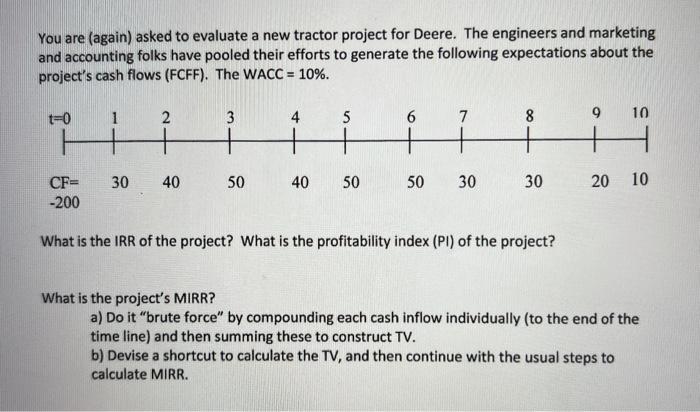

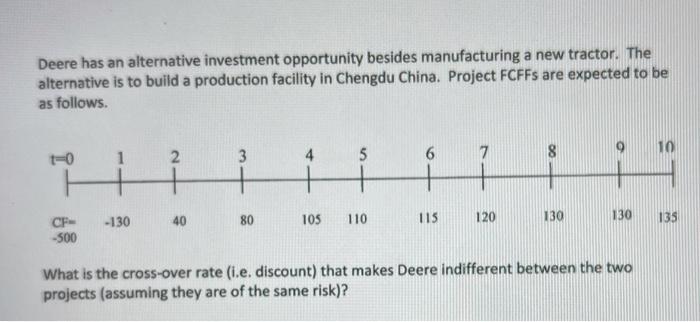

You are (again) asked to evaluate a new tractor project for Deere. The engineers and marketing and accounting folks have pooled their efforts to generate the following expectations about the project's cash flows (FCFF). The WACC = 10%. t=0 1 2 2 3 4 5 6 7 8 9 10 30 40 50 40 50 50 30 30 20 10 CF= -200 What is the IRR of the project? What is the profitability index (PI) of the project? What is the project's MIRR? a) Do it "brute force" by compounding each cash inflow individually (to the end of the time line) and then summing these to construct TV. b) Devise a shortcut to calculate the TV, and then continue with the usual steps to calculate MIRR. Deere has an alternative investment opportunity besides manufacturing a new tractor. The alternative is to build a production facility in Chengdu China. Project FCFFs are expected to be as follows. -0 2 3 5 6 -130 80 40 105 110 130 115 130 120 135 CF- -500 What is the cross-over rate (i.e. discount) that makes Deere indifferent between the two projects (assuming they are of the same risk)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts