Question: You are (again) asked to evaluate a new tractor project for Deere.The engineets and marketing and accounting folks have pooled their effors to generate the

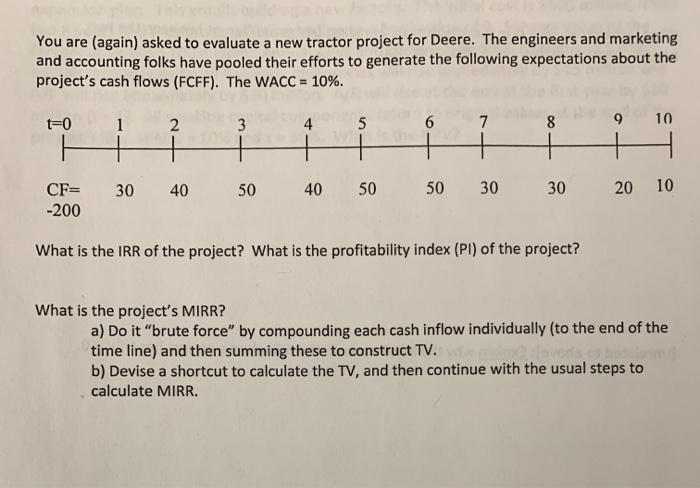

You are (again) asked to evaluate a new tractor project for Deere. The engineers and marketing and accounting folks have pooled their efforts to generate the following expectations about the project's cash flows (FCFF). The WACC = 10%. t=0 2 3 4 5 9 10 CF= -200 30 40 50 40 50 50 30 30 20 10 What is the IRR of the project? What is the profitability index (PI) of the project? What is the project's MIRR? a) Do it "brute force" by compounding each cash inflow individually (to the end of the time line) and then summing these to construct TV. b) Devise a shortcut to calculate the TV, and then continue with the usual steps to calculate MIRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts