Question: You are choosing between two projects, A and B, and must choose the project that adds most value to you. Suppose Project A's cost today

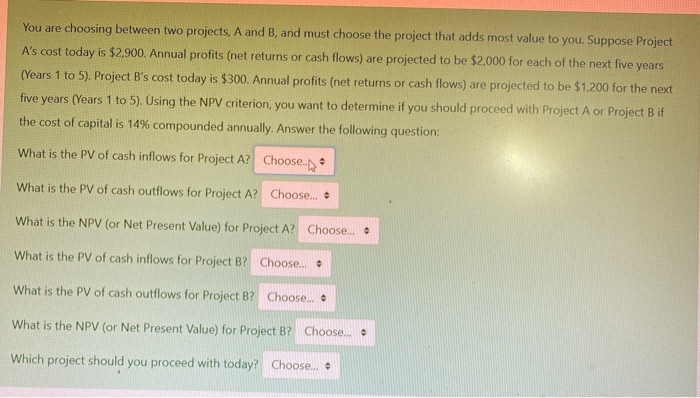

You are choosing between two projects, A and B, and must choose the project that adds most value to you. Suppose Project A's cost today is $2,900. Annual profits (net returns or cash flows) are projected to be $2,000 for each of the next five years (Years 1 to 5). Project B's cost today is $300. Annual profits (net returns or cash flows) are projected to be $1,200 for the next five years (Years 1 to 5). Using the NPV criterion, you want to determine if you should proceed with Project A or Project B if the cost of capital is 14% compounded annually. Answer the following question: What is the PV of cash inflows for Project A? Choose What is the PV of cash outflows for Project A? Choose... What is the NPV (or Net Present Value) for Project A? Choose... What is the PV of cash inflows for Project B? Choose.... What is the PV of cash outflows for Project B? Choose... What is the NPV (or Net Present Value) for Project B? Choose .. Which project should you proceed with today? Choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts