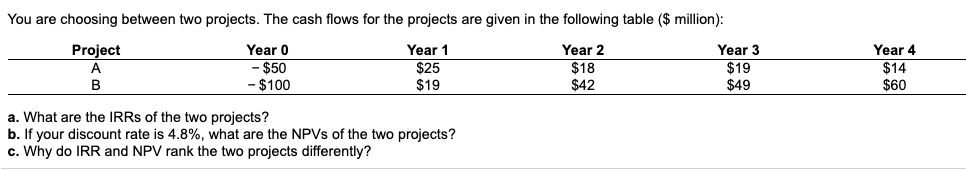

Question: You are choosing between two projects. The cash flows for the projects are given in the following table ($ million): Project Year 0 Year 1

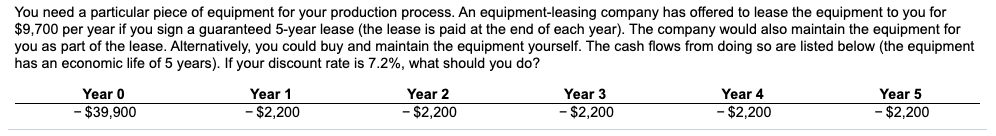

You are choosing between two projects. The cash flows for the projects are given in the following table ($ million): Project Year 0 Year 1 Year 2 Year 3 - $50 $25 $18 $19 - $100 $19 $42 $49 Year 4 $14 $60 a. What are the IRRs of the two projects? b. If your discount rate is 4.8%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently? You need a particular piece of equipment for your production process. An equipment-leasing company has offered to lease the equipment to you for $9,700 per year if you sign a guaranteed 5-year lease the lease is paid at the end of each year). The company would also maintain the equipment for you as part of the lease. Alternatively, you could buy and maintain the equipment yourself. The cash flows from doing so are listed below (the equipment has an economic life of 5 years). If your discount rate is 7.2%, what should you do? Year 0 - $39,900 Year 1 - $2,200 Year 2 - $2,200 Year 3 - $2,200 Year 4 - $2,200 Year 5 - $2,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts