Question: You are enrolling in an MBA program. To pay your tuition, you can either take out a standard student loan (so the interest payments are

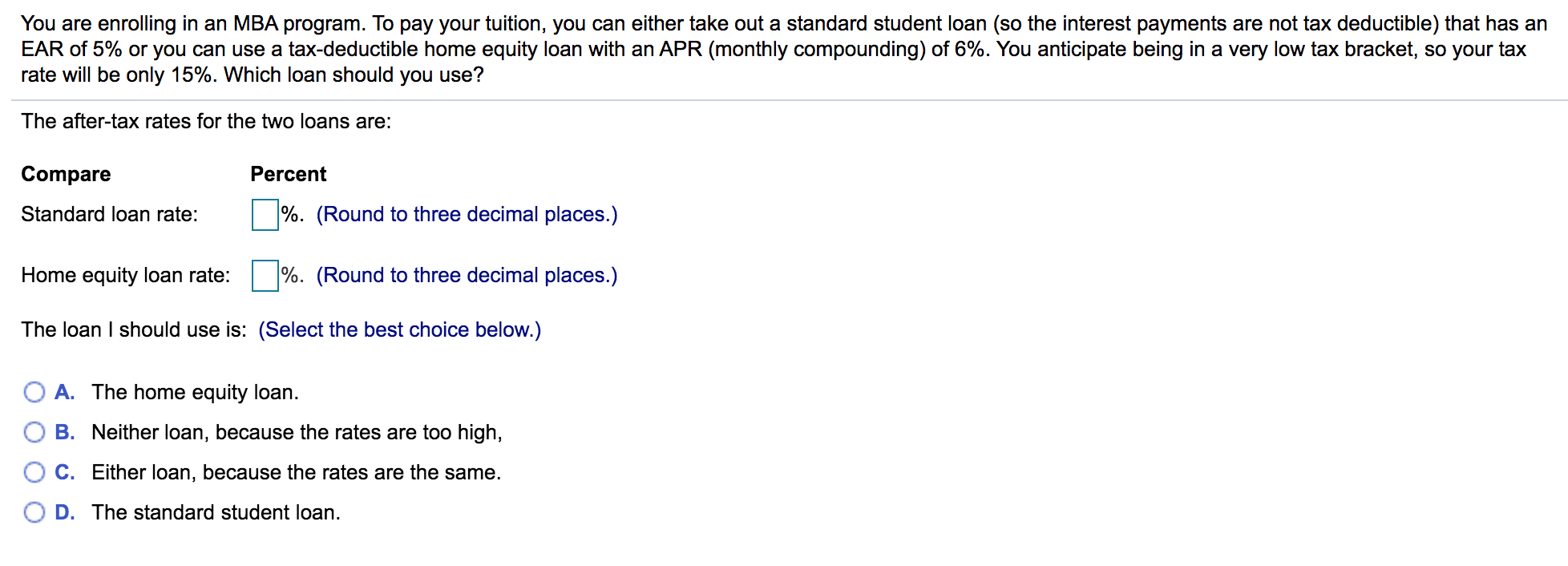

You are enrolling in an MBA program. To pay your tuition, you can either take out a standard student loan (so the interest payments are not tax deductible) that has an EAR of 5% or you can use a tax-deductible home equity loan with an APR (monthly compounding) of 6%. You anticipate being in a very low tax bracket, so your tax rate will be only 15%. Which loan should you use? The after-tax rates for the two loans are: Compare Percent Standard loan rate: %. (Round to three decimal places.) Home equity loan rate: %. (Round to three decimal places.) The loan I should use is: (Select the best choice below.) O A. The home equity loan. B. Neither loan, because the rates are too high, C. Either loan, because the rates are the same. D. The standard student loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts