Question: You are evaluating two quantitative factor funds Vanguard Small-Value ETF (VBR) and Blackrock's iShares MSCI USA Quality Factor ETF (QUAL). Information about the two funds

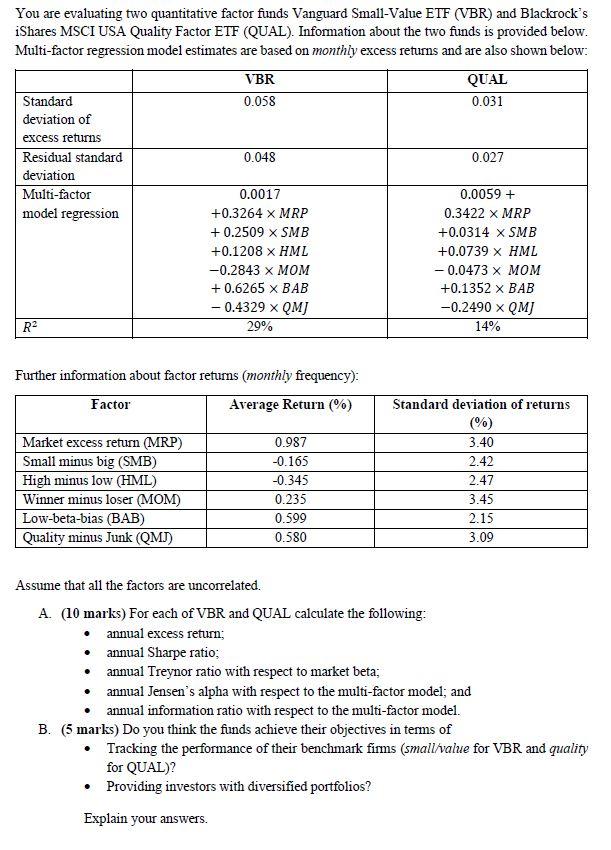

You are evaluating two quantitative factor funds Vanguard Small-Value ETF (VBR) and Blackrock's iShares MSCI USA Quality Factor ETF (QUAL). Information about the two funds is provided below. Multi-factor regression model estimates are based on monthly excess returns and are also shown below: VBR QUAL 0.031 Standard 0.058 deviation of 0.048 0.027 excess returns Residual standard deviation Multi-factor model regression 0.0017 0.0059 + +0.3264 x MRP 0.3422 X MRP +0.2509 X SMB +0.0314 x SMB +0.1208 X HML +0.0739 X HML -0.2843 X MOM +0.6265 X BAB -0.0473 X MOM +0.1352 x BAB -0.4329 x QM) 29% -0.2490 x QMJ 14% R2 Further information about factor returns (monthly frequency): Factor Average Return (%) Standard deviation of returns (%) 3.40 0.987 -0.165 2.42 -0.345 2.47 Market excess return (MRP) Small minus big (SMB) High minus low (HML) Winner minus loser (MOM) Low-beta-bias (BAB) Quality minus Junk (QMJ) 0.235 3.45 0.599 2.15 0.580 3.09 Assume that all the factors are uncorrelated. . A. (10 marks) For each of VBR and QUAL calculate the following: annual excess return; annual Sharpe ratio: annual Treynor ratio with respect to market beta; annual Jensen's alpha with respect to the multi-factor model; and annual information ratio with respect to the multi-factor model. B. (5 marks) Do you think the funds achieve their objectives in terms of Tracking the performance of their benchmark fimms (small/value for VBR and quality for QUAL)? Providing investors with diversified portfolios? Explain your answers. You are evaluating two quantitative factor funds Vanguard Small-Value ETF (VBR) and Blackrock's iShares MSCI USA Quality Factor ETF (QUAL). Information about the two funds is provided below. Multi-factor regression model estimates are based on monthly excess returns and are also shown below: VBR QUAL 0.031 Standard 0.058 deviation of 0.048 0.027 excess returns Residual standard deviation Multi-factor model regression 0.0017 0.0059 + +0.3264 x MRP 0.3422 X MRP +0.2509 X SMB +0.0314 x SMB +0.1208 X HML +0.0739 X HML -0.2843 X MOM +0.6265 X BAB -0.0473 X MOM +0.1352 x BAB -0.4329 x QM) 29% -0.2490 x QMJ 14% R2 Further information about factor returns (monthly frequency): Factor Average Return (%) Standard deviation of returns (%) 3.40 0.987 -0.165 2.42 -0.345 2.47 Market excess return (MRP) Small minus big (SMB) High minus low (HML) Winner minus loser (MOM) Low-beta-bias (BAB) Quality minus Junk (QMJ) 0.235 3.45 0.599 2.15 0.580 3.09 Assume that all the factors are uncorrelated. . A. (10 marks) For each of VBR and QUAL calculate the following: annual excess return; annual Sharpe ratio: annual Treynor ratio with respect to market beta; annual Jensen's alpha with respect to the multi-factor model; and annual information ratio with respect to the multi-factor model. B. (5 marks) Do you think the funds achieve their objectives in terms of Tracking the performance of their benchmark fimms (small/value for VBR and quality for QUAL)? Providing investors with diversified portfolios? Explain your answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts