Question: You are evaluating two quantitative factor funds Vanguard Small-Value ETF (VBR) and Blackrock's iShares MSCI USA Quality Factor ETF (QUAL). Information about the two funds

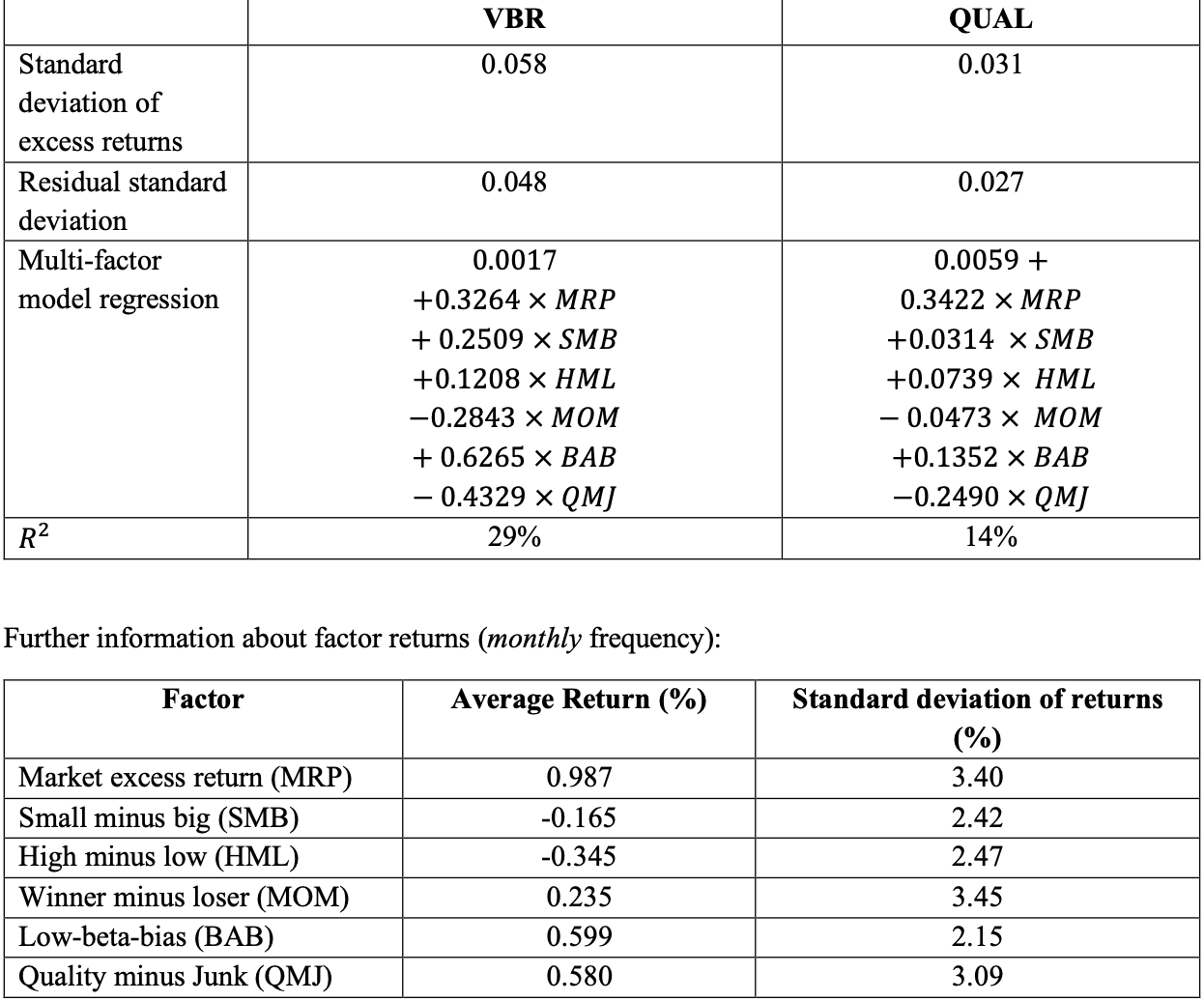

You are evaluating two quantitative factor funds Vanguard Small-Value ETF (VBR) and Blackrock's iShares MSCI USA Quality Factor ETF (QUAL). Information about the two funds is provided below. Multi-factor regression model estimates are based on monthly excess returns and are also shown below:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts