Question: You are examining the stock returns for Random Inc which are assumed to be normally distributed. The expected return is 18%, and the standard deviation

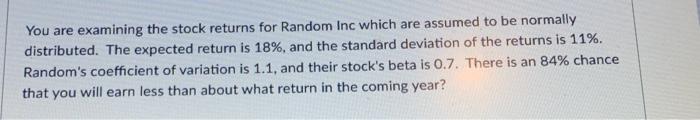

You are examining the stock returns for Random Inc which are assumed to be normally distributed. The expected return is 18%, and the standard deviation of the returns is 11%. Random's coefficient of variation is 1.1 , and their stock's beta is 0.7 . There is an 84% chance that you will earn less than about what return in the coming year? You are examining the stock returns for Random Inc which are assumed to be normally distributed. The expected return is 18%, and the standard deviation of the returns is 11%. Random's coefficient of variation is 1.1 , and their stock's beta is 0.7 . There is an 84% chance that you will earn less than about what return in the coming year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts