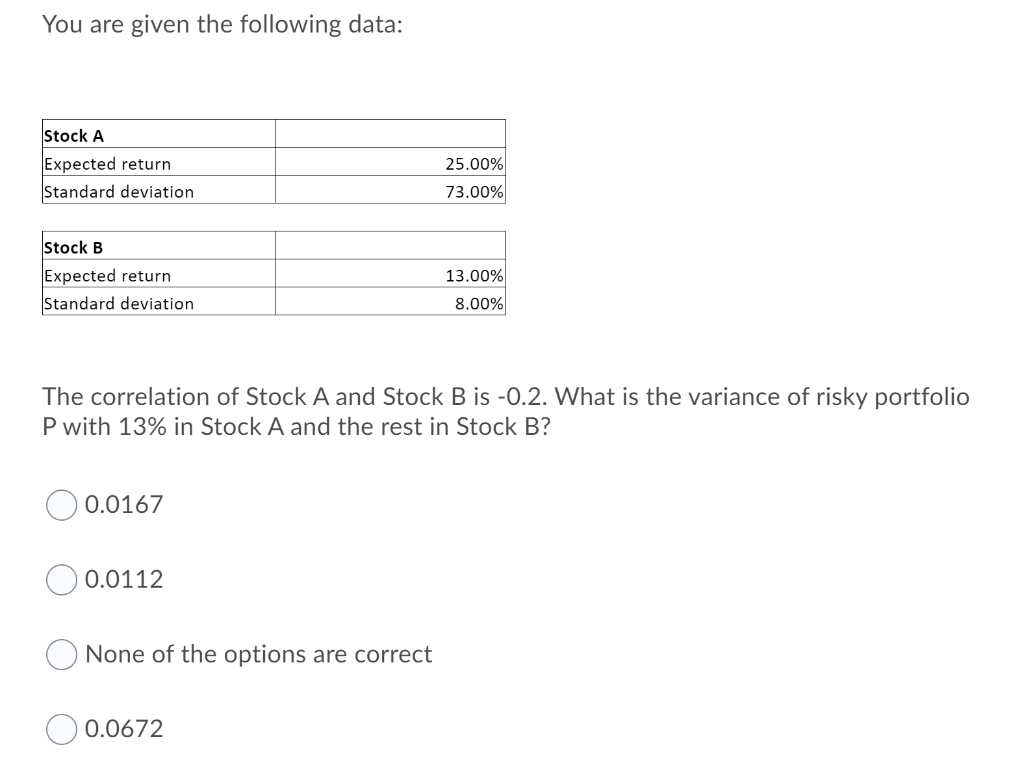

Question: You are given the following data: Stock A Expected return Standard deviation 25.00% 73.00% Stock B Expected return Standard deviation 13.00% 8.00% The correlation of

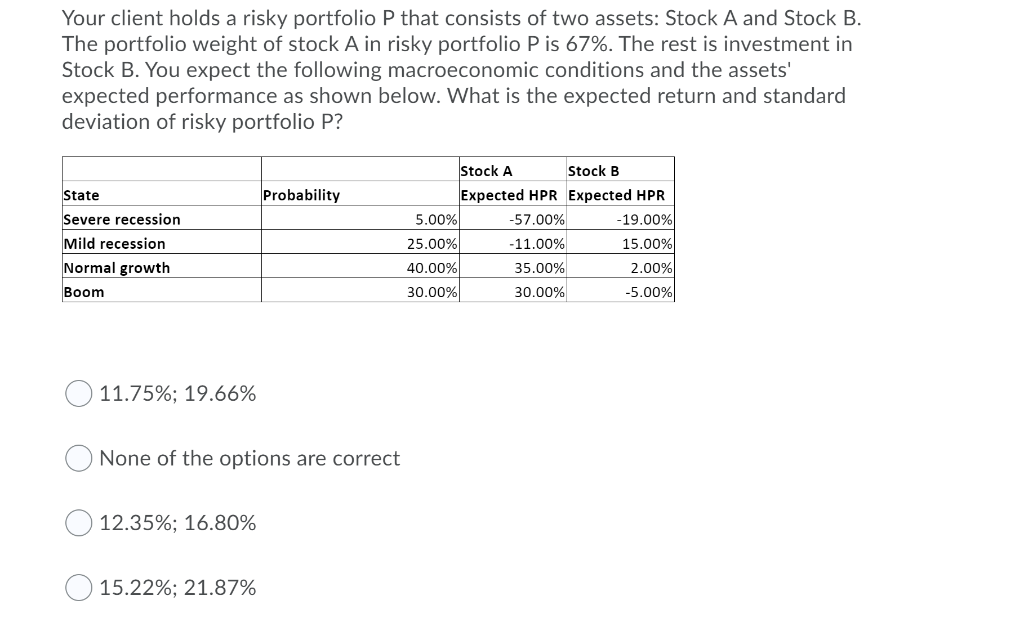

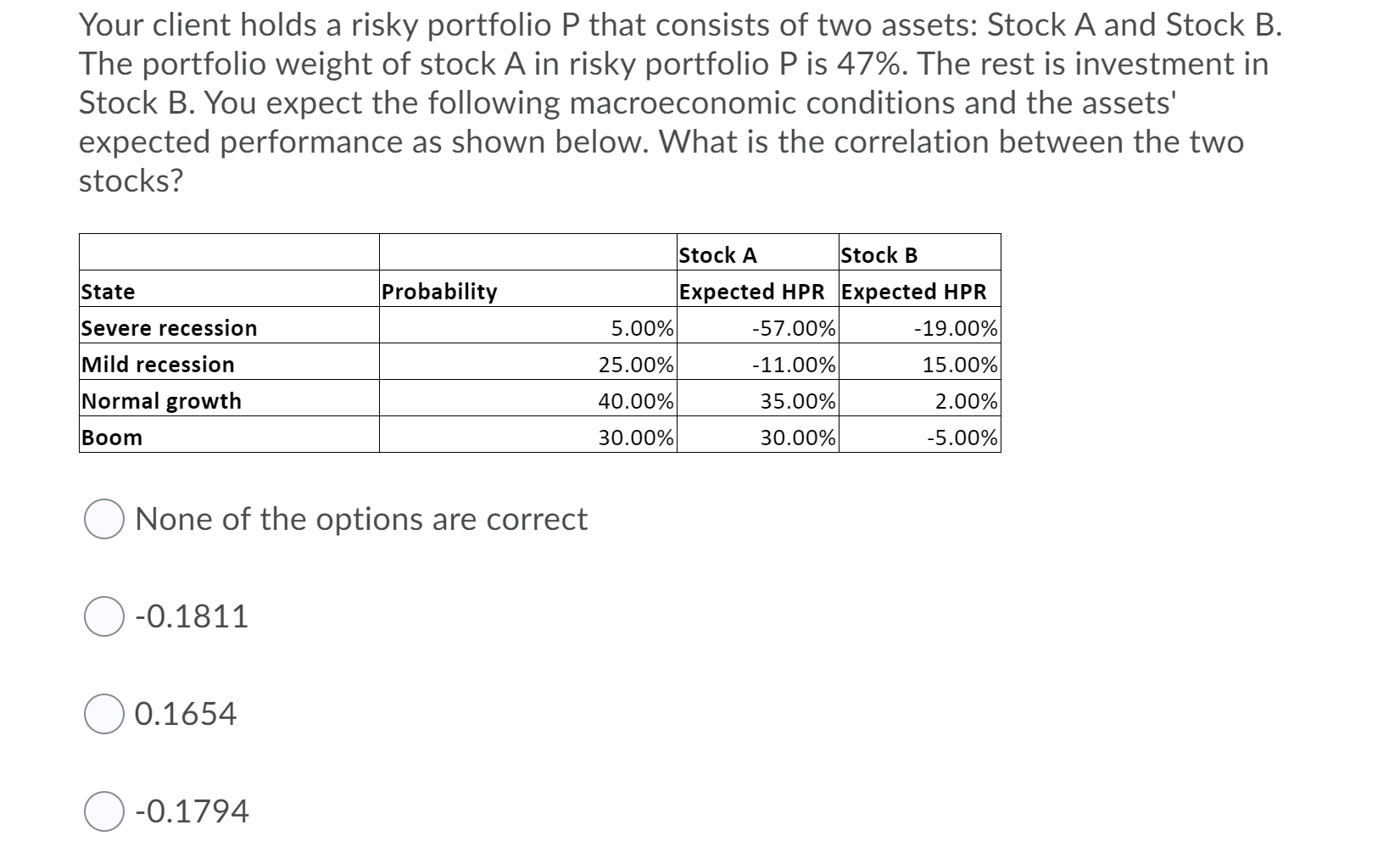

You are given the following data: Stock A Expected return Standard deviation 25.00% 73.00% Stock B Expected return Standard deviation 13.00% 8.00% The correlation of Stock A and Stock B is -0.2. What is the variance of risky portfolio P with 13% in Stock A and the rest in Stock B? 0.0167 0.0112 None of the options are correct 0.0672 Your client holds a risky portfolio P that consists of two assets: Stock A and Stock B. The portfolio weight of stock A in risky portfolio P is 67%. The rest is investment in Stock B. You expect the following macroeconomic conditions and the assets' expected performance as shown below. What is the expected return and standard deviation of risky portfolio P? Probability Stock A Stock B Expected HPR Expected HPR 5.00% -57.00% -19.00% State Severe recession Mild recession Normal growth Boom 25.00% - 11.00% 15.00% 40.00% 35.00% 2.00% -5.00% 30.00% 30.00% 11.75%; 19.66% None of the options are correct 12.35%; 16.80% 15.22%; 21.87% Your client holds a risky portfolio P that consists of two assets: Stock A and Stock B. The portfolio weight of stock A in risky portfolio P is 47%. The rest is investment in Stock B. You expect the following macroeconomic conditions and the assets' expected performance as shown below. What is the correlation between the two stocks? Stock A Stock B State Probability Expected HPR Expected HPR 5.00% -57.00% -19.00% Severe recession Mild recession 25.00% -11.00% 15.00% Normal growth 40.00% 35.00% 2.00% Boom 30.00% 30.00% -5.00% None of the options are correct -0.1811 0.1654 -0.1794

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts