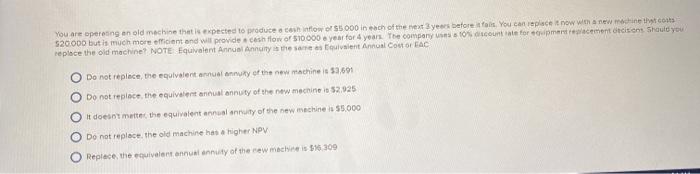

Question: You are operating an old machine that is expected to produce inflow of $5000 in each of the next years before fals You can replace

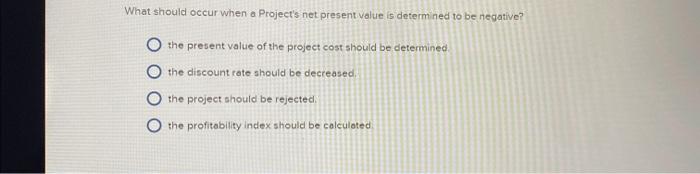

You are operating an old machine that is expected to produce inflow of $5000 in each of the next years before fals You can replace now won a new hit costs 520.000 but is much more efficient and will provide cesh flow of $10000 year for 4 years. The company to count rate for mentrelacement dit ont Should you replace the old machine NOTE Equivalent Annual Annuity is the same as tualent Annual Couto CAC Do not replace the equivalent annuality of the new machine is 53,691 Do not replace the equivalent annual annuty of the new machine is 52.925 It doesnt matter the equivalent annual annuity of the new machine in 55.000 @ Do not replace the old machine has a higher NPV Replace the equivalent annual annuty of the new machines 36309 What should occur when a Project's net present value is determined to be negative? the present value of the project cost should be determined the discount rate should be decreased, the project should be rejected. the profitability Index should be calculated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts