Question: You are required to select TWO funds in the same category with distinctive performance in term of 3-year return. Analyse the different performance of

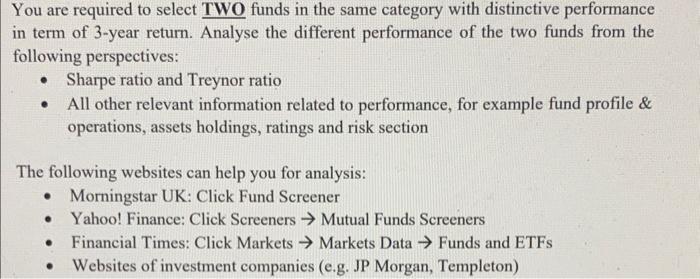

You are required to select TWO funds in the same category with distinctive performance in term of 3-year return. Analyse the different performance of the two funds from the following perspectives: Sharpe ratio and Treynor ratio All other relevant information related to performance, for example fund profile & operations, assets holdings, ratings and risk section . The following websites can help you for analysis: Morningstar UK: Click Fund Screener Yahoo! Finance: Click Screeners Mutual Funds Screeners Financial Times: Click Markets Markets Data Funds and ETFs Websites of investment companies (e.g. JP Morgan, Templeton) Callable bond exhibits different interest rate risk exposure compared with that of straight bond. Evaluate the importance of the difference in the current interest rate environment.

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step 11 Sure here are two mutual funds with distinctive performance in terms of 3year return 1 The V... View full answer

Get step-by-step solutions from verified subject matter experts