Question: . You are trying to decide whether to open a new restaurant, so you are uncertain about what your annual revenues and costs might be.

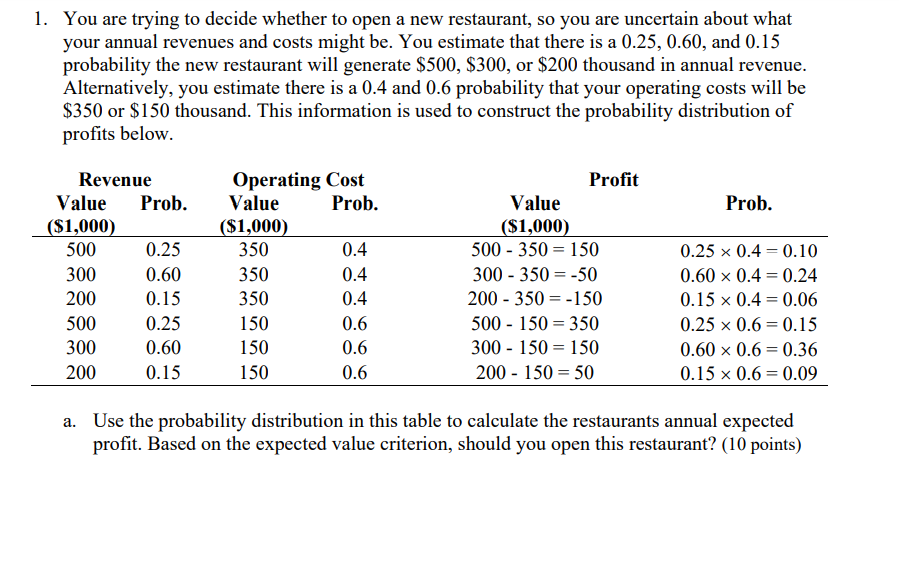

. You are trying to decide whether to open a new restaurant, so you are uncertain about what your annual revenues and costs might be. You estimate that there is a 0.25, 0.60, and 0.15 probability the new restaurant will generate $500, $300, or $200 thousand in annual revenue. Alternatively, you estimate there is a 0.4 and 0.6 probability that your operating costs will be $350 or $150 thousand. This information is used to construct the probability distribution of prots below. Revenue Operating Cost Prot Value Prob. Value Prob. Value Prob. ($1,000) ($1,000) ($1,000) 500 0.25 350 0.4 500 - 350 = 150 0.25 x 0.4 = 0.10 300 0.60 350 0.4 300 - 350 = -50 0.60| x 0.4 = 0.24 200 0.15 350 0.4 200 - 350 = -150 0.15 x 0.4 = 0.06 500 0.25 150 0.6 500 - 150 = 350 0.25 x 0.6 = 0.15 300 0.60 150 0.6 300 - 150 = 150 0.60| x 0.6 = 0.36 200 0.15 150 0.6 200 - 150 = 50 0.15 x 0.6 = 0.09 a. Use the probability distribution in this table to calculate the restaurants annual expected prot. Based on the expected value criterion, should you open this restaurant? {10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts