Question: You currently sell a product with a variable cost per unit of $21 and a unit selling price of $39. At present, you only sell

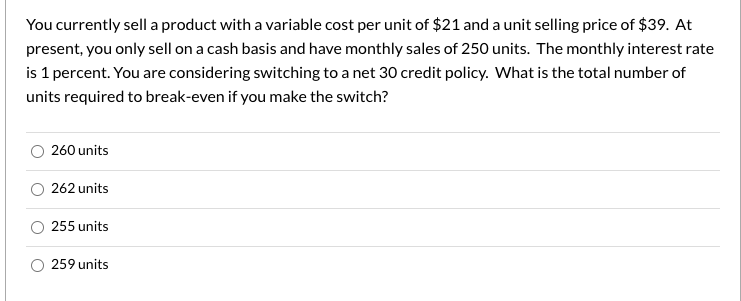

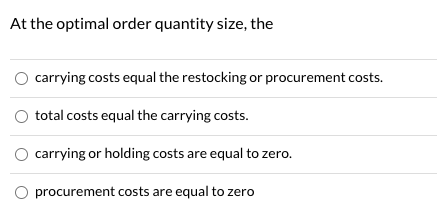

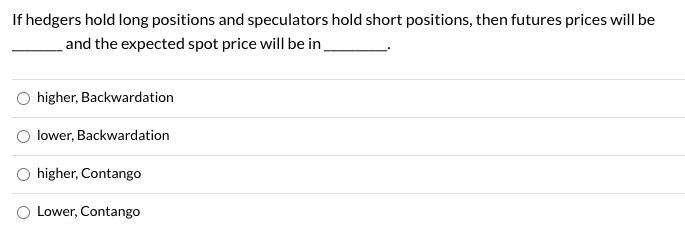

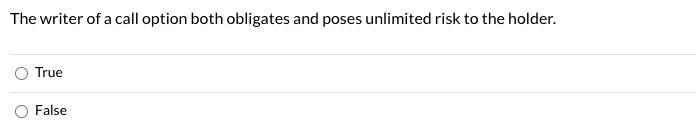

You currently sell a product with a variable cost per unit of $21 and a unit selling price of $39. At present, you only sell on a cash basis and have monthly sales of 250 units. The monthly interest rate is 1 percent. You are considering switching to a net 30 credit policy. What is the total number of units required to break-even if you make the switch? 260 units 262 units 255 units 259 units At the optimal order quantity size, the carrying costs equal the restocking or procurement costs. total costs equal the carrying costs. carrying or holding costs are equal to zero. procurement costs are equal to zero If hedgers hold long positions and speculators hold short positions, then futures prices will be and the expected spot price will be in higher, Backwardation lower, Backwardation higher, Contango O Lower, Contango The writer of a call option both obligates and poses unlimited risk to the holder. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts