Question: you do not have to answer question e See pages 154-155 requirements a-d for this week assignment (Ryan Boot Company). **For requirement a Just complete

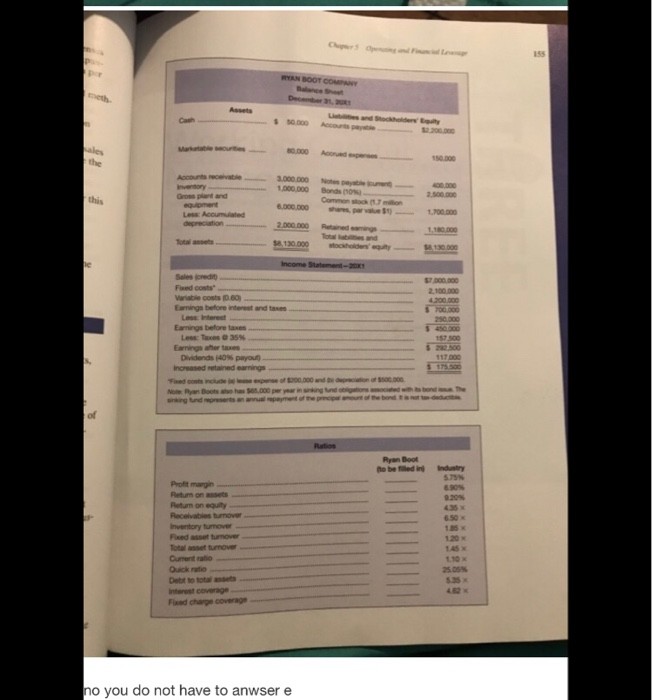

See pages 154-155 requirements a-d for this week assignment (Ryan Boot Company). **For requirement "a" Just complete two ratios the first and the last ratio and not all 13 ratios. Complete requirement b, c, and d as required. Comprehensive Problem 1. Ryan Boot Company (review of Chapters 2 through 5) (multiple LO's from Chapters 2 through 5) COMPREHENSIVE PROBLEM Boot C uty Analyze Ryan Boot Company, using ratio analysis. Compute the R piwo Chapters and compare them to the industry data that are given. Discuss the h 5) strong points, and what you think should be done to improve the cu Los performance. b. In your analysis, calculate the overall break-even point in sales dollars and cash break-even point. Also compute the degree of operating leverapeder financial leverage, and degree of combined leverage. (Use footnote 2 for Do and footnote 3 for DCL) c. Use the information in parts a and b to discuss the risk associated with this company. Given the risk, decide whether a bank should lend funds to Ryan Boot Ryan Boot Company is trying to plan the funds needed for 20x2. The manage anticipates an increase in sales of 20 percent, which can be absorbed without in ing fixed assets. & What would be Ryan's needs for external funds based on the current balance sheet? Compute RNF (required new funds). Notes payable (current) and bonds are not part of the liability calculation What would be the required new funds if the company brings its ratios into lise with the industry average during 20XZ? Specifically examine receivables tur over, inventory turnover, and the profit margin. Use the new values to reco the factors in RNF (assume liabilities stay the same). RYAN BOOT COM Assa 200.000 30.000 150.000 Accounts receive Inventory Gross plant and equipment Les Accumulated 2.500.000 Comm on 6.000.000 1.700.000 2.000.000 $8,130.000 stochody 1130.000 Income State -20 Salcedit Fed costs Variable costs 0.60 Earnings before 7.000.000 2.100.000 4.200.000 7780 and taxes Earnings before taxes 201300 Dividends 40 payout Increased retained earnings 115500 N an Booth ,000 gudo bond the to be fed in dustry 5.73% 6.30 Profit margin Return on Return on equity Recehabis turnover Inventory tumover Faced a turnover Total turnover Dumentato Quick ratio 1.10 25 OSN Intro coverage Fed charge coverage no you do not have to anwser e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts