Question: You have been given the following return data on three assetsA, B, andCover the period 20212024. A) Calculate the average portfolio return for each of

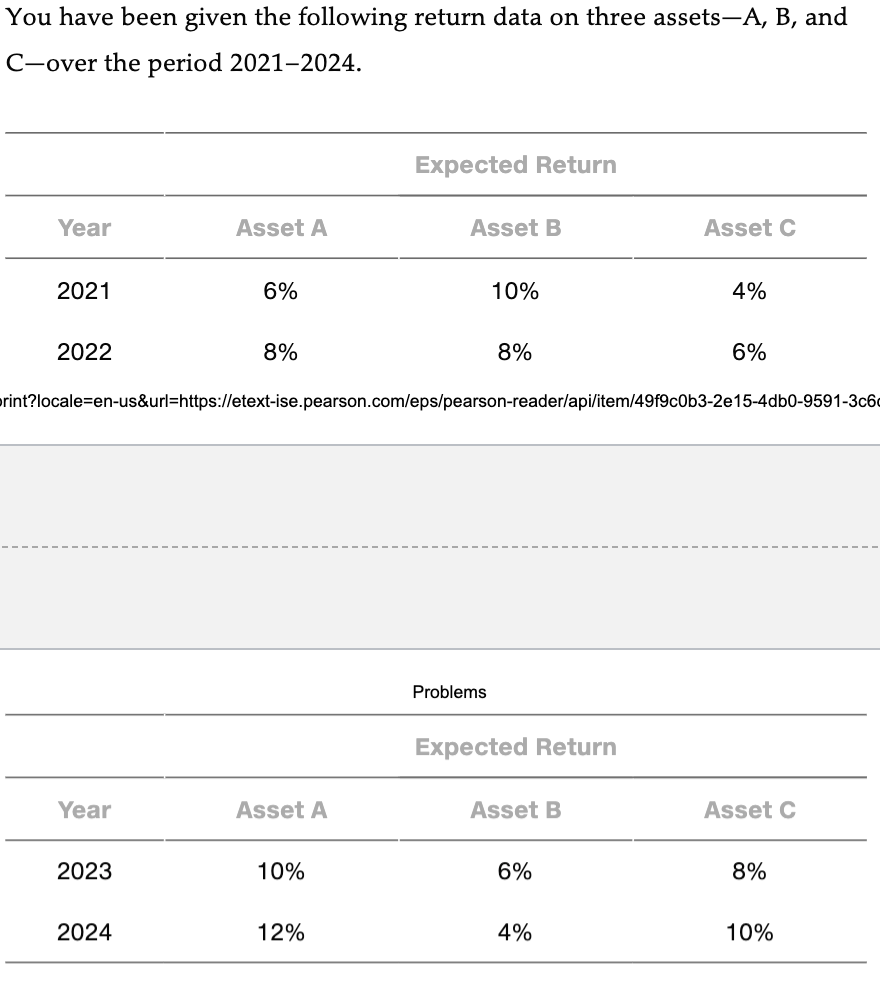

You have been given the following return data on three assetsA, B, andCover the period 20212024.

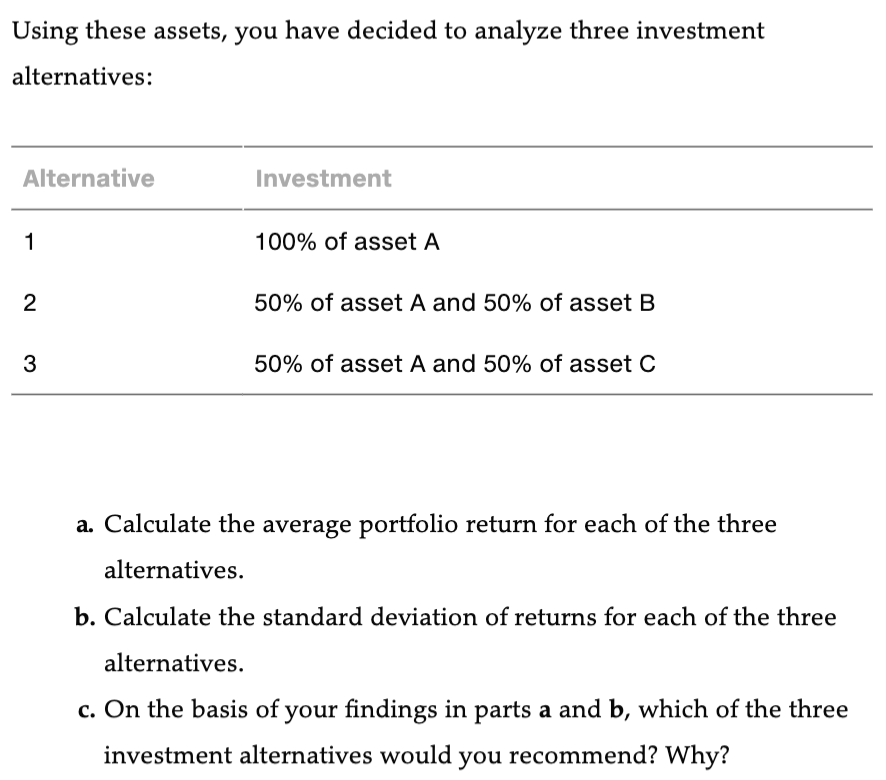

A) Calculate the average portfolio return for each of the three alternatives

B) Calculate the standard deviation of returns for each of the three alternatives

C) On the basis of your findings in parts a and b, which of the three investment alternatives would you recommend? Why?

You have been given the following return data on three assets-A, B, and C-over the period 2021-2024. Expected Return Year Asset A Asset B Asset C 2021 6% 10% 4% 2022 8% 8% 6% rint?locale=en-us&url=https://etext-ise.pearson.com/eps/pearson-reader/api/item/49f9c0b3-2e15-4db0-9591-3c6 Problems Expected Return Year Asset A Asset B Asset C 2023 10% 6% 8% 2024 12% 4% 10% Using these assets, you have decided to analyze three investment alternatives: Alternative Investment 1 1 100% of asset A 2 50% of asset A and 50% of asset B B 3 50% of asset A and 50% of asset C a. Calculate the average portfolio return for each of the three alternatives. b. Calculate the standard deviation of returns for each of the three alternatives. c. On the basis of your findings in parts a and b, which of the three investment alternatives would you recommend? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts