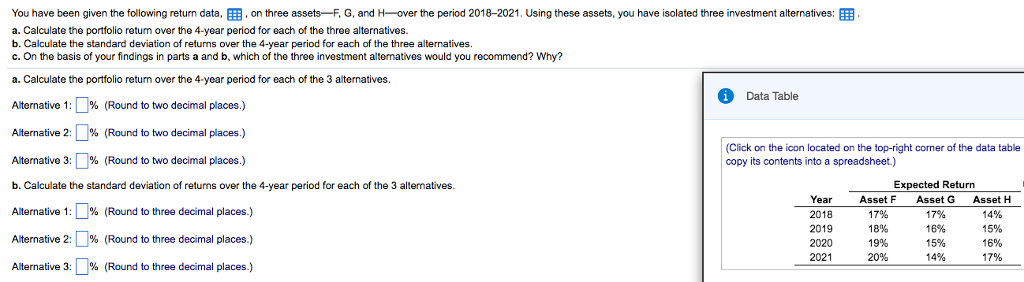

Question: You have been given the following return data, on three assets F, G, and H-ver the period 2018-2021. Using these assets, you have isolated three

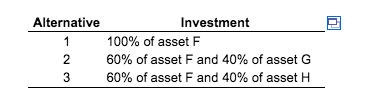

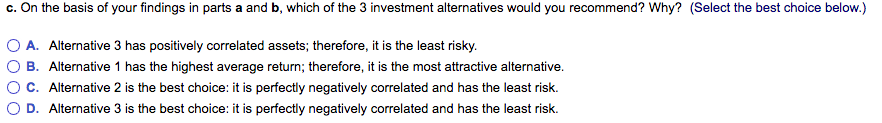

You have been given the following return data, on three assets F, G, and H-ver the period 2018-2021. Using these assets, you have isolated three investment alternatives: a. Calculate the portfolio returm over the 4-year period for each of the three alternatives. b. Calculate the standard deviation of returns over the 4-year period for each of the three alternatives. c. On the basis of your findings in parts a and b, which of the three investment alternatives would you recommend? Why? a. Calculate the portfolio returm over the 4-year period for each of the 3 alternatives. Alternative 1: % (Round to two decimal places.) Alternative 2: 1 % ( Alternative 3: | % (Round to two decimal places.) b. Calculate the standard deviation of returns over the 4-year period for each of the 3 alternatives Alternative 1: % (Round to three decimal places.) Alternative 2: | % (Round to three decimal places.) Alternative 3: | % (Round to three decimal places.) Data Table to two decimal places.) (Click on the icon located on the top-right corner of the data table copy its contents into a spreadsheet.) Ex Return Year 2018 2019 2020 2021 Asset F 17% 18% 19% 20% Asset G 17% 16% 15% 14% Asset H 14% 15% 16% 17%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts