Question: You have estimated a survival default and prepayment model with the following variables and estimated coefficients Default B Variable FICO OLTV DTI Prepayment Borrower 1

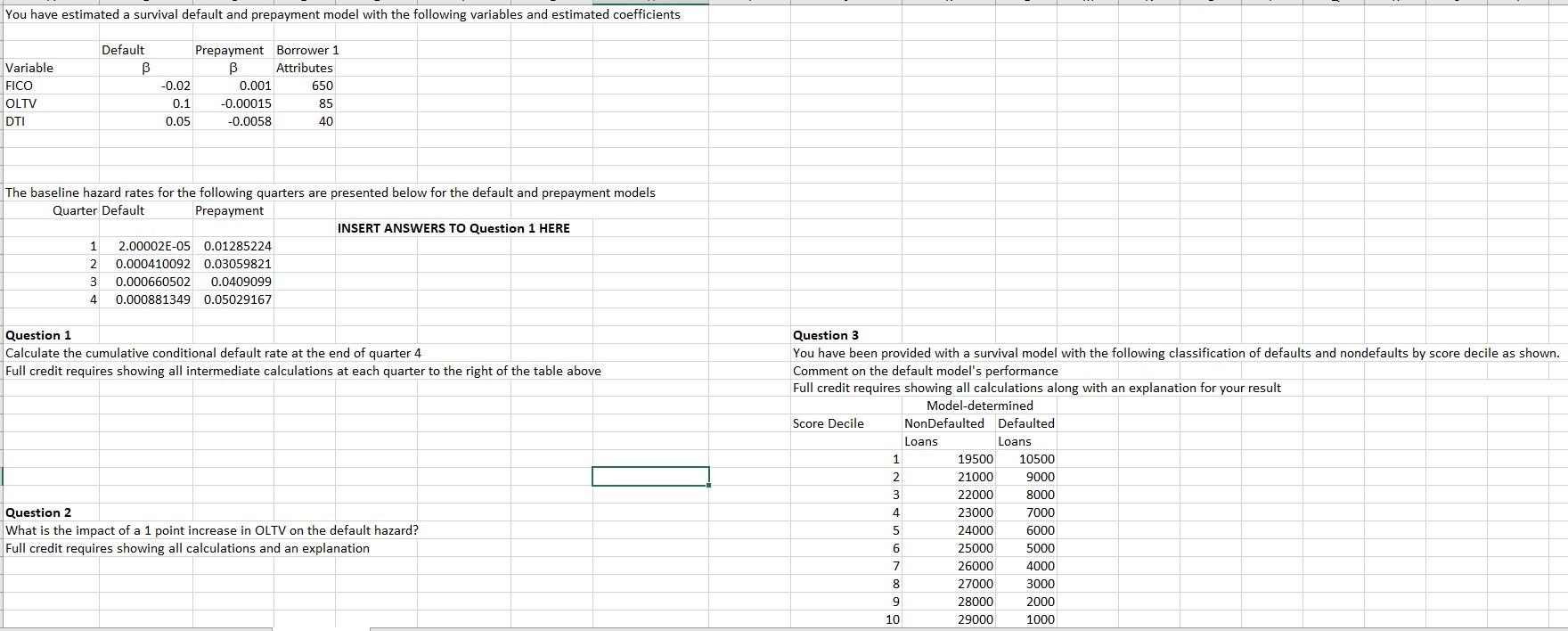

You have estimated a survival default and prepayment model with the following variables and estimated coefficients Default B Variable FICO OLTV DTI Prepayment Borrower 1 B Attributes -0.02 0.001 650 0.1 -0.00015 85 0.05 -0.0058 40 The baseline hazard rates for the following quarters are presented below for the default and prepayment models Quarter Default Prepayment INSERT ANSWERS TO Question 1 HERE 1 2.00002E-05 0.01285224 2 0.000410092 0.03059821 3 0.000660502 0.0409099 4 0.000881349 0.05029167 Question 1 Calculate the cumulative conditional default rate at the end of quarter 4 Full credit requires showing all intermediate calculations at each quarter to the right of the table above Question 3 You have been provided with a survival model with the following classification of defaults and nondefaults by score decile as shown. Comment on the default model's performance Full credit requires showing all calculations along with an explanation for your result Model-determined Score Decile NonDefaulted Defaulted Loans Loans 1 19500 10500 2 21000 9000 3 22000 8000 4 23000 7000 5 24000 6000 6 25000 5000 7 26000 4000 8 27000 3000 9 28000 2000 10 29000 1000 Question 2 What is the impact of a 1 point increase in OLTV on the default hazard? Full credit requires showing all calculations and an explanation You have estimated a survival default and prepayment model with the following variables and estimated coefficients Default B Variable FICO OLTV DTI Prepayment Borrower 1 B Attributes -0.02 0.001 650 0.1 -0.00015 85 0.05 -0.0058 40 The baseline hazard rates for the following quarters are presented below for the default and prepayment models Quarter Default Prepayment INSERT ANSWERS TO Question 1 HERE 1 2.00002E-05 0.01285224 2 0.000410092 0.03059821 3 0.000660502 0.0409099 4 0.000881349 0.05029167 Question 1 Calculate the cumulative conditional default rate at the end of quarter 4 Full credit requires showing all intermediate calculations at each quarter to the right of the table above Question 3 You have been provided with a survival model with the following classification of defaults and nondefaults by score decile as shown. Comment on the default model's performance Full credit requires showing all calculations along with an explanation for your result Model-determined Score Decile NonDefaulted Defaulted Loans Loans 1 19500 10500 2 21000 9000 3 22000 8000 4 23000 7000 5 24000 6000 6 25000 5000 7 26000 4000 8 27000 3000 9 28000 2000 10 29000 1000 Question 2 What is the impact of a 1 point increase in OLTV on the default hazard? Full credit requires showing all calculations and an explanation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts