Question: You have identified two mutually exclusive investment projects. The initial cost and the present value of the two projects are identical. Both projects have an

You have identified two mutually exclusive investment projects. The initial cost and the present value of the two projects are identical. Both projects have an economic life of two years.

| Initial Investment | PV of the Project | Annual Volatility of the Project | |

| Project 1 | $100 million | $125 million | 25% |

| Project 2 | $100 million | $125 million | 35% |

You realize that the projects have an option to contract. You can scale down the operations by 40% at any time during the next two years. When you scale down, you can receive $54 million cash from contracting the operation from Project 1 and $50 million cash from Project 2. The WACC for Investment is 12%, and the risk-free interest rate is 2%.

(a) What is the risk-neutral probability for the two projects?

(b) Find the value of the two projects with the real options approach.

(c) What is the value of the option to contract?

(d) Based on your results, which project will you recommend?

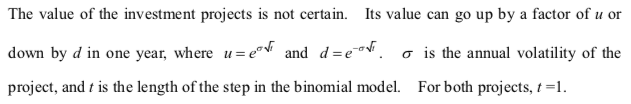

The value of the investment projects is not certain. Its value can go up by a factor of u or down by d in one year, where u=cov and d=eon o is the annual volatility of the project, and t is the length of the step in the binomial model. For both projects, t =1. The value of the investment projects is not certain. Its value can go up by a factor of u or down by d in one year, where u=cov and d=eon o is the annual volatility of the project, and t is the length of the step in the binomial model. For both projects, t =1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts