Question: You have identified two mutually exclusive investment projects. The initial cost and the present value of the two projects are identical. Both projects have an

You have identified two mutually exclusive investment projects. The initial cost and the present value of the two projects are identical. Both projects have an economic life of two years.

| Initial Investment | PV of the Project | Annual Volatility of the Project | |

| Project 1 | $100 million | $125 million | 25% |

| Project 2 | $100 million | $125 million | 35% |

(a) Calculate the NPV of the two projects. According to the NPV analysis, which one will you prefer? Why?

(b) Find u and d.

(c) Draw the two-year binomial tree to describe the value of the two projects.

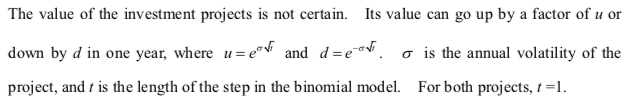

The value of the investment projects is not certain. Its value can go up by a factor of u or down by d in one year, where u=cov and d=eon o is the annual volatility of the project, and t is the length of the step in the binomial model. For both projects, t =1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts