Question: You have three options as outlined below. Which option would you choose? Why? Show your workings to explain your decision. Again, work in pairs

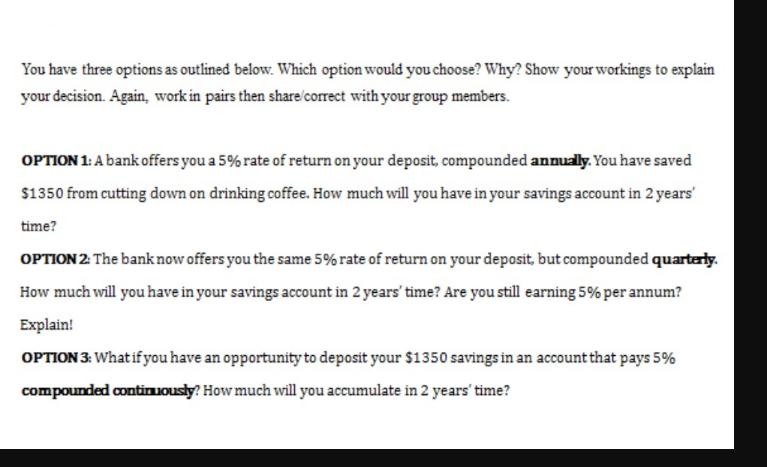

You have three options as outlined below. Which option would you choose? Why? Show your workings to explain your decision. Again, work in pairs then share/correct with your group members. OPTION 1: A bank offers you a 5% rate of return on your deposit, compounded annually. You have saved $1350 from cutting down on drinking coffee. How much will you have in your savings account in 2 years' time? OPTION 2: The bank now offers you the same 5% rate of return on your deposit, but compounded quarterly. How much will you have in your savings account in 2 years' time? Are you still earning 5% per annum? Explain! OPTION 3: What if you have an opportunity to deposit your $1350 savings in an account that pays 5% compounded continuously? How much will you accumulate in 2 years' time?

Step by Step Solution

There are 3 Steps involved in it

To compare the options we need to calculate the future value of the savings account for each option ... View full answer

Get step-by-step solutions from verified subject matter experts