Question: You have two mutually - exclusive projects. The first project ( P 1 ) has an initial investment of 1 7 . 2 million Czech

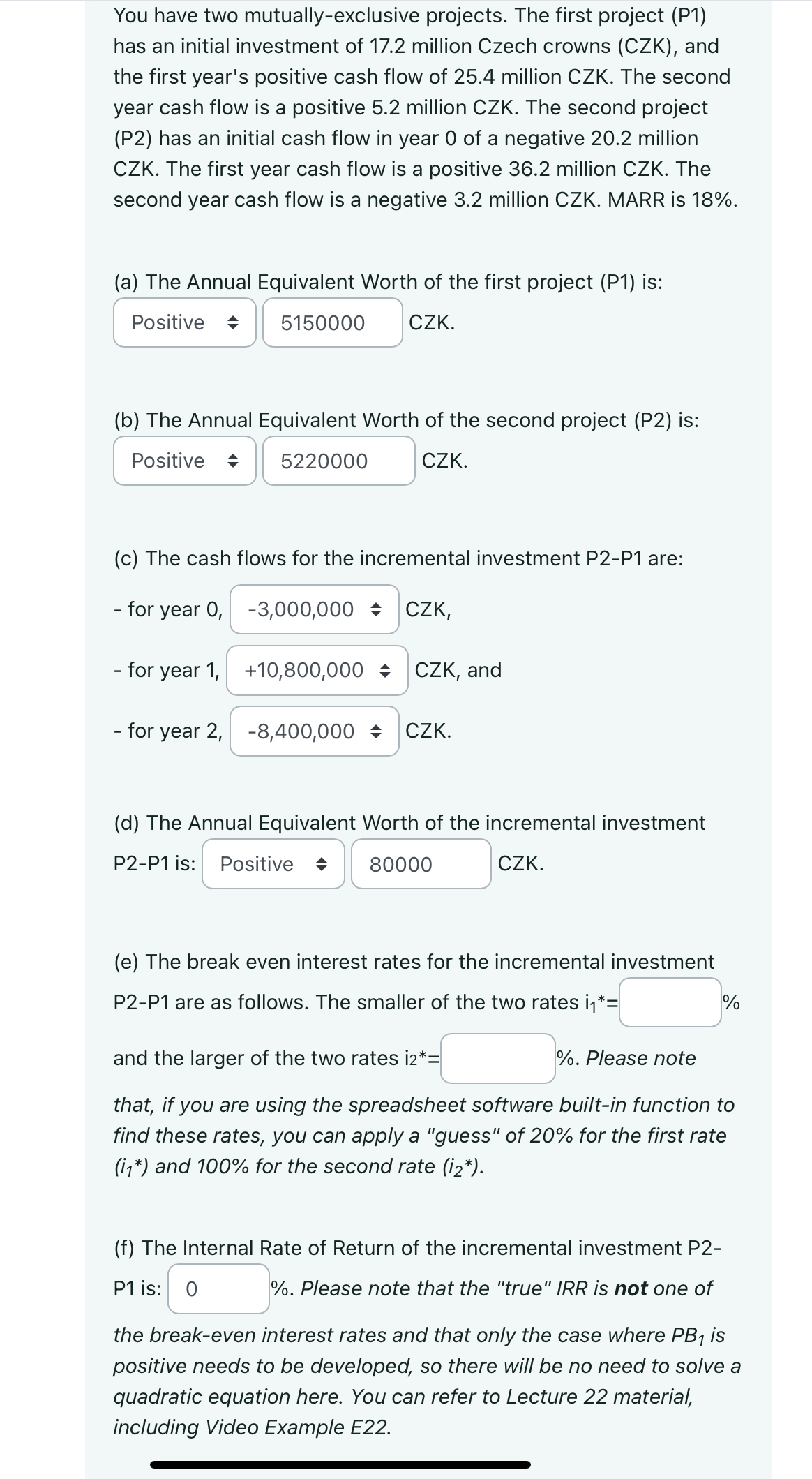

You have two mutuallyexclusive projects. The first project P has an initial investment of million Czech crowns CZK and the first year's positive cash flow of million CZK The second year cash flow is a positive million CZK The second project P has an initial cash flow in year of a negative million CZK The first year cash flow is a positive million CZK The second year cash flow is a negative million CZK MARR is

a The Annual Equivalent Worth of the first project P is:

CZK

b The Annual Equivalent Worth of the second project P is:

CZK

c The cash flows for the incremental investment PP are:

table for year CZK for year CZK and for year CZK

d The Annual Equivalent Worth of the incremental investment PP is: CZK

e The break even interest rates for the incremental investment PP are as follows. The smaller of the two rates and the larger of the two rates Please note that, if you are using the spreadsheet software builtin function to find these rates, you can apply a "guess" of for the first rate and for the second rate

f The Internal Rate of Return of the incremental investment PP is: Please note that the "true" IRR is not one of the breakeven interest rates and that only the case where is positive needs to be developed, so there will be no need to solve a quadratic equation here. You can refer to Lecture material, including Video Example E

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock