Question: You may need to use the appropriate appendix table or technology to answer this question. To analyze the risk, or volatility, associated with investing in

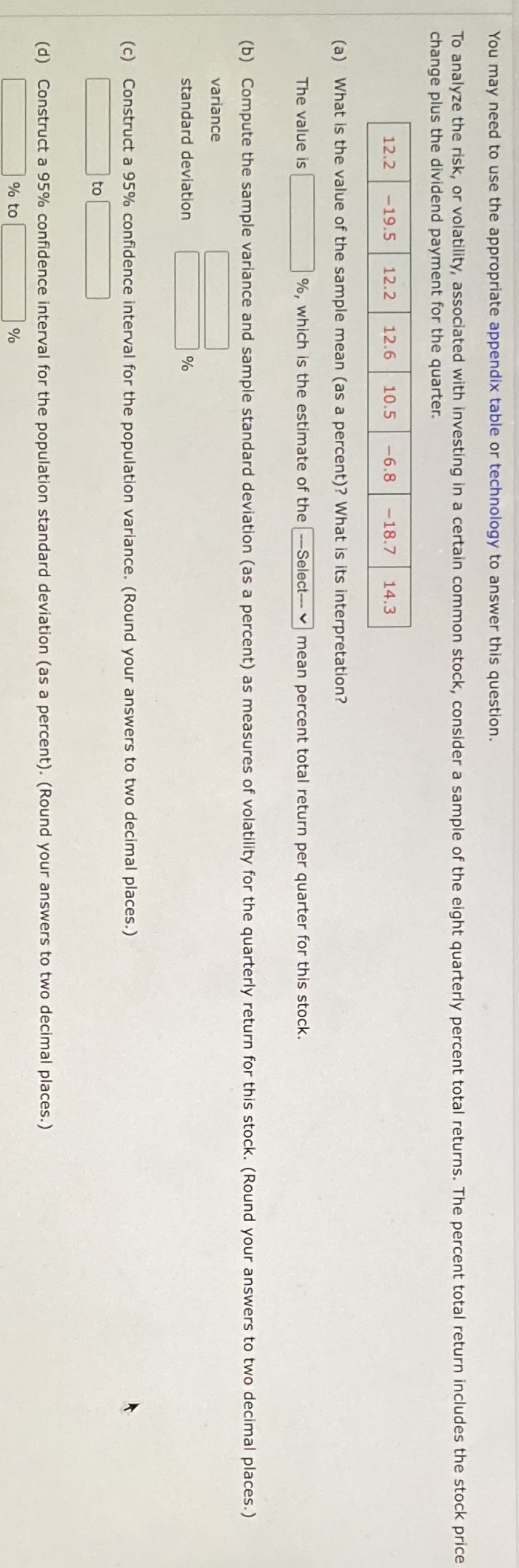

You may need to use the appropriate appendix table or technology to answer this question. To analyze the risk, or volatility, associated with investing in a certain common stock, consider a sample of the eight quarterly percent total returns. The percent total return includes the stock price change plus the dividend payment for the quarter. 12.2 -19.5 12.2 12.6 10.5 -6.8 -18.7 14.3 (a) What is the value of the sample mean (as a percent)? What is its interpretation? The value is %, which is the estimate of the --Select- | mean percent total return per quarter for this stock. (b) Compute the sample variance and sample standard deviation (as a percent) as measures of volatility for the quarterly return for this stock. (Round your answers to two decimal places.) variance standard deviation (c) Construct a 95% confidence interval for the population variance. (Round your answers to two decimal places.) (d) Construct a 95% confidence interval for the population standard deviation (as a percent). (Round your answers to two decimal places.) % to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts