Question: - You must submit an MS Excel table that shows the following headings for each of the three types of depreciation. Consider creating a new

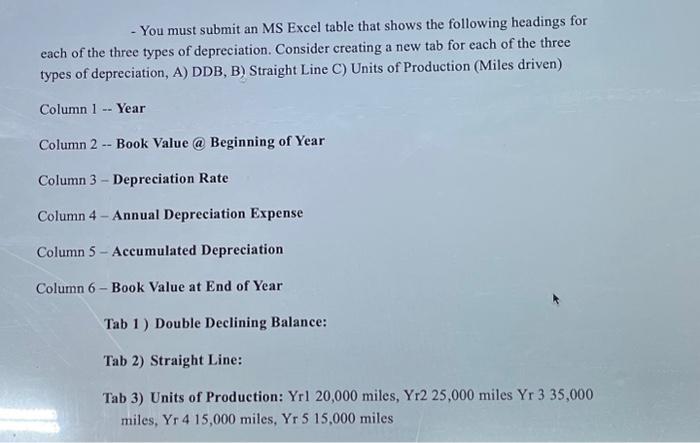

- You must submit an MS Excel table that shows the following headings for each of the three types of depreciation. Consider creating a new tab for each of the three types of depreciation, A) DDB, B) Straight Line C) Units of Production (Miles driven) Column 1 -- Year Column 2 -- Book Value @ Beginning of Year Column 3 - Depreciation Rate Column 4 - Annual Depreciation Expense Column 5 -Accumulated Depreciation Column 6 - Book Value at End of Year Tab 1) Double Declining Balance: Tab 2) Straight Line: Tab 3) Units of Production: Yrl 20,000 miles, Yr2 25,000 miles Yr miles, Yr 4 15,000 miles, Yr 5 15,000 miles - You must submit an MS Excel table that shows the following headings for each of the three types of depreciation. Consider creating a new tab for each of the three types of depreciation, A) DDB, B) Straight Line C) Units of Production (Miles driven) Column 1 -- Year Column 2 -- Book Value @ Beginning of Year Column 3 - Depreciation Rate Column 4 - Annual Depreciation Expense Column 5 -Accumulated Depreciation Column 6 - Book Value at End of Year Tab 1) Double Declining Balance: Tab 2) Straight Line: Tab 3) Units of Production: Yrl 20,000 miles, Yr2 25,000 miles Yr miles, Yr 4 15,000 miles, Yr 5 15,000 miles

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts