Question: You will be put in a simulated HR role working on a merger/acquisition. This will require a balance of critical thinking, access to your text

You will be put in a simulated HR role working on a merger/acquisition. This will require a balance of critical thinking, access to your text book, and a professional touch to your report writing skills. You are very excited! Today you have started a new position as Director, HR - Mergers and Acquisitions at WeBuyThem Inc. WeBuyThem Inc. is a well-known, global company who is known for buying other companies, and also for being a big career step for future C level executives; And your position is very sought after! Your job description was not completely clear during the hiring process, but moments ago Mrs.Money, the Chief Financial Officer of WeBuyThem Inc. approached you and said Welcome to WeBuyThem, my director of finance called in sick. I hear you have taken Managerial Accounting, and I need you to help me assess a possible new acquisition. The company is called BigStep Limited, and they are asking for $12M for all their outstanding common shares. She hands you a list of work items, and an information package.

You are nervous, but still excited, the CFO needs you!

After a quick internet check you see BigStep Limited produces and sells electric scooters.

Mrs. Money's Instruction

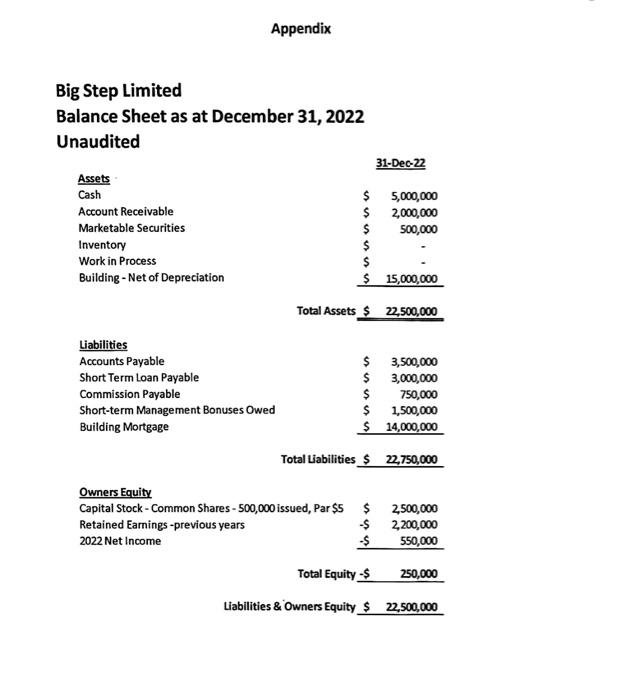

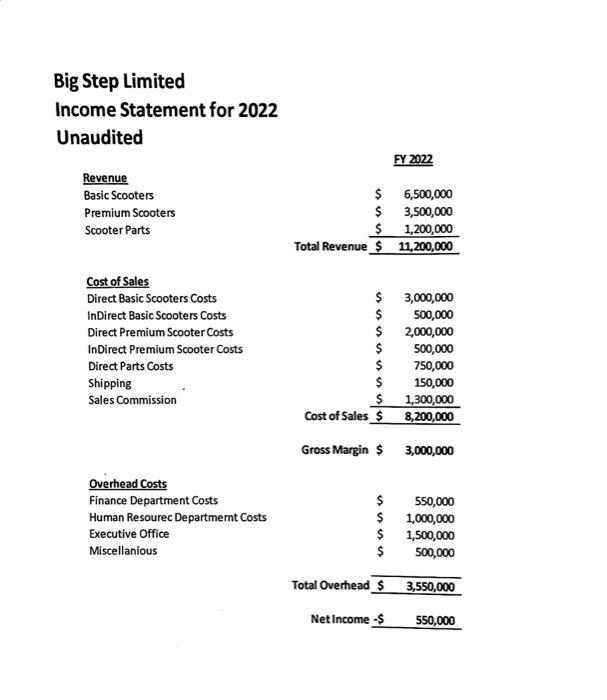

1. Do a financial statement analysis on BigStep Limited, specifically: a. December 31, 2022- Calculate Working Capital b. December 31, 2022- Calculate Current Ratio c. December 31, 2022- Calculate Quick ratio d. December 31, 2022- Calculate Debt Ratio e. Fiscal 2022 - Calculate Gross Profit % f. Fiscal 2022 Calculate Net Income % g. December 31, 2022 (Fiscal 2022) - Earnings Per Share

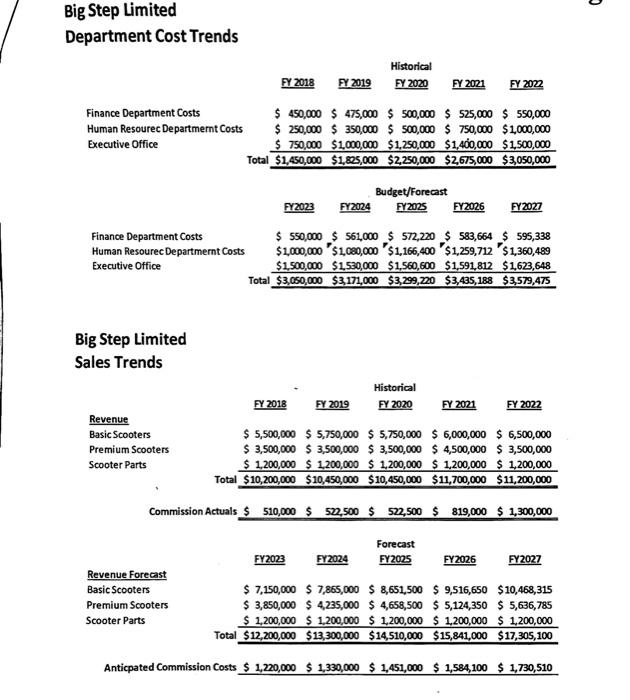

2. Analyze BigSteps HRs Historical Expense Trend for the last 5 years Comments?

3. Analysis BigSteps next 5 Year HR Cost Forecast Comments?

4. Look at BigSteps direct product and indirect costs for FY2022 Comments?

5. Whats is Big Steps Product Mix Percentage for 2022?

6. Look at BigSteps direct labour costs for the last 5 years Comments?

7. What is BigSteps Premium Scooter Unit Contribution Margin for 2022?

8. Analysis BigSteps next 5 Year Sales Revenue Forecast Comments?

9. Analysis BigSteps Sales Revenues vs the Commission Expenses Comments?

10. Welcome to WeBuyThem!

11. Would you recommend buying Big Step Limited for the $12M? Why/Why not?

Appendix I I Big Step Limited Income Statement for 2022 Unaudited FY 2022 Revenue \begin{tabular}{lrr} Basic Scooters & $ & 6,500,000 \\ Premium Scooters & $ & 3,500,000 \\ Scooter Parts & $ & 1,200,000 \\ \cline { 3 - 3 } & Total Revenue & 11,200,000 \\ \hline \end{tabular} Cost of Sales Gross Margin $3,000,000 Overhead Costs FinanceDepartmentCostsHumanResourecDepartmerntCostsExecutiveOfficeMiscellanious$$$$550,0001,000,0001,500,000500,000 Total Overhead \( \longdiv { \$ \quad 3 , 5 5 0 , 0 0 0 } \) Net Income -\$ 550,000 Big Step Limited Big Step Limited

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts