Question: You will be required to submit a midterm paper to demonstrate your understanding of the concept of project selection. This assignment will provide you the

You will be required to submit a midterm paper to demonstrate your understanding of the concept of project selection. This assignment will provide you the opportunity to explore the weight scoring method of project selection and ranking among alternatives and also making decisions on how to decide a favourable project from cash flow point of view.

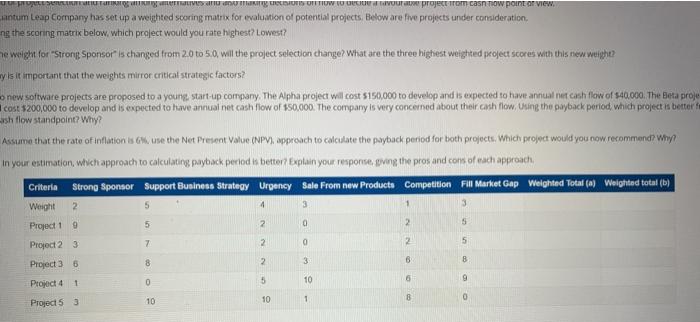

The Quantum Leap Company has set up a weighted scoring matrix for evaluation of potential projects. Below are five projects under consideration.

Using the scoring matrix below, which project would you rate highest? Lowest?

If the weight for Strong Sponsor is changed from 2.0 to 5.0, will the project selection change? What are the three highest weighted project scores with this new weight?

Why is it important that the weights mirror critical strategic factors?

Two new software projects are proposed to a young, start-up company. The Alpha project will cost $150,000 to develop and is expected to have annual net cash flow of $40,000. The Beta project will cost $200,000 to develop and is expected to have annual net cash flow of $50,000. The company is very concerned about their cash flow. Using the payback period, which project is better from a cash flow standpoint? Why?

Assume that the rate of inflation is 6%, use the Net Present Value (NPV), approach to calculate the payback period for both projects. Which project would you now recommend? Why?

In your estimation, which approach to calculating payback period is better? Explain your response, giving the pros and cons of each approach.

Criteria Strong Sponsor Support Business Strategy Urgency Sale From new Products Competition

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock