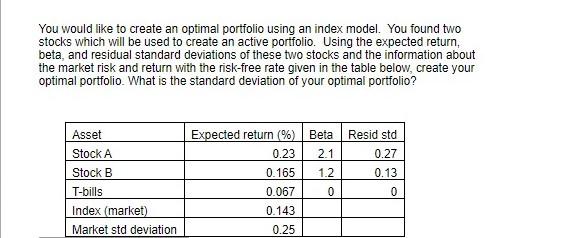

Question: You would like to create an optimal portfolio using an index model. You found two stocks which will be used to create an active portfolio.

You would like to create an optimal portfolio using an index model. You found two stocks which will be used to create an active portfolio. Using the expected return, beta, and residual standard deviations of these two stocks and the information about the market risk and return with the risk-free rate given in the table below, create your optimal portfolio What is the standard deviation of your optimal portfolio? Asset Stock A Stock B T-bills Index (market) Market std deviation Expected return (%) Beta 0.23 2.1 0.165 1.2 0.067 0 0.143 0.25 Resid std 0.27 0.13 0 You would like to create an optimal portfolio using an index model. You found two stocks which will be used to create an active portfolio. Using the expected return, beta, and residual standard deviations of these two stocks and the information about the market risk and return with the risk-free rate given in the table below, create your optimal portfolio What is the standard deviation of your optimal portfolio? Asset Stock A Stock B T-bills Index (market) Market std deviation Expected return (%) Beta 0.23 2.1 0.165 1.2 0.067 0 0.143 0.25 Resid std 0.27 0.13 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts