Question: Your answer is incorrect. Sandra was put in a nursing home with advanced dementia in early March. The doctors at the nursing home have determined

Your answer is incorrect.

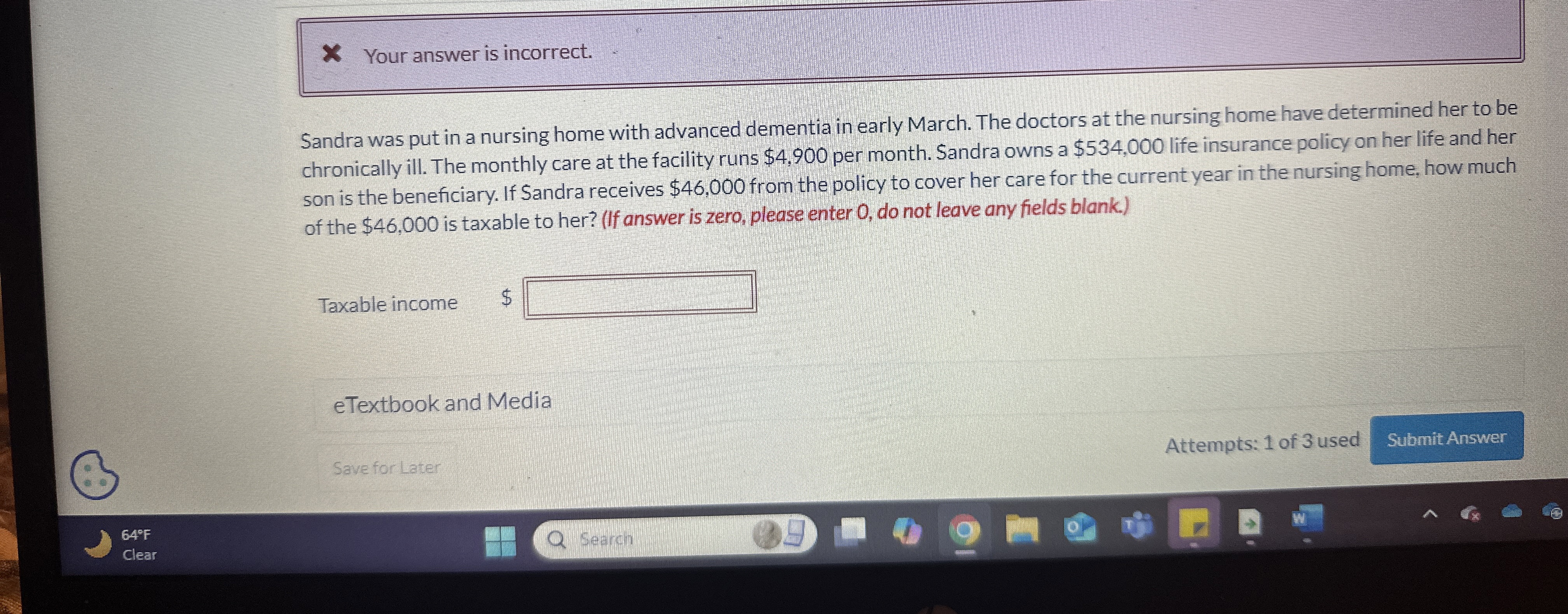

Sandra was put in a nursing home with advanced dementia in early March. The doctors at the nursing home have determined her to be

chronically ill. The monthly care at the facility runs $ per month. Sandra owns a $ life insurance policy on her life and her

son is the beneficiary. If Sandra receives $ from the policy to cover her care for the current year in the nursing home, how much

of the $ is taxable to her? If answer is zero, please enter do not leave any fields blank.

Taxable income

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock