Question: Your assignment submission must in either Word or Excel and uploaded (one file only) to the assignment drop-box before 11:59pm on Saturday April 3.

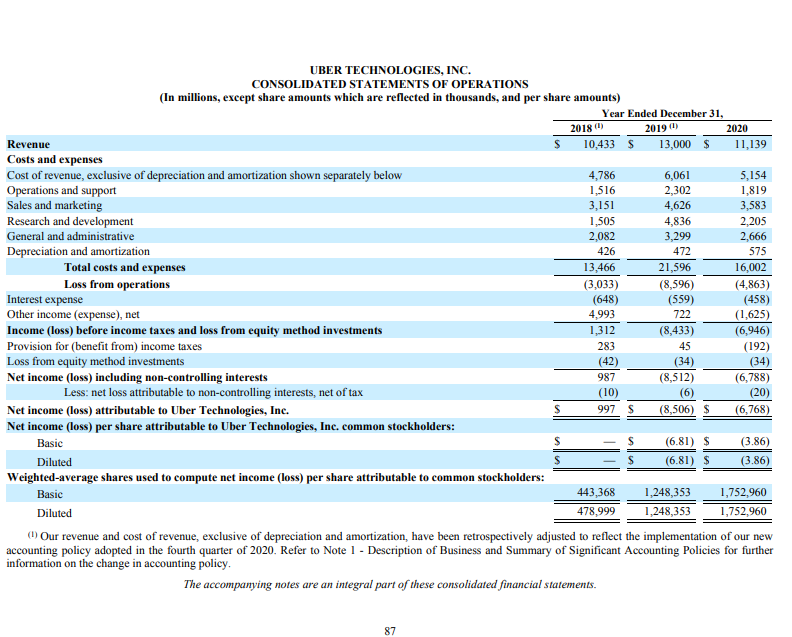

Your assignment submission must in either Word or Excel and uploaded (one file only) to the assignment drop-box before 11:59pm on Saturday April 3. This assignment may be done individually or in pairs. If you are working in pairs then only one copy of the assignment needs to be submitted. Please indicated both student names and student numbers in the file name. Question 1 Recently, Uber released its financial statements for the year ended Dec 31 2020. It showed a loss of $6.7 billion on sales of 11.1 billion. Some analysts are quick to blame Covid-19 for this loss, but others pointed to bigger long-term issues and reminded investors that the showed a loss of $8.5 billion on sales of 13.0billion in 2019. Assume the following cost structure: Cost of Sales and Operations and support are all variable, and all of the other costs (Sales and Marketing, R+D all fixed, General and admin, Depreciation and Amortization) are all fixed. 1. Based on 2020 information on page 87 of the financial statements (provided with this assignment), how big would revenues have to have been in 2020 in order for Uber to break even? [for simplicity purposes, you can ignore items such as interest expense, other income/expenses, income taxes, gains/losses on equity method investments, and issues related to minority interests]? 2. How much would sales have to grow each year over 5 years in order for Uber to break even? 3. Suppose Uber's grand plan is to become a monopoly by driving everyone else out of industry and then raising fairs. How much would prices have to increase to break even if Uber felt they would be a monopoly once they reached sales of $18billion? 4. Do you think investors will ever see a return on their investment? (see attached article) Revenue Costs and expenses Cost of revenue, exclusive of depreciation and amortization shown separately below Operations and support Sales and marketing Research and development General and administrative Depreciation and amortization UBER TECHNOLOGIES, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except share amounts which are reflected in thousands, and per share amounts) Total costs and expenses Loss from operations Interest expense Other income (expense), net Income (loss) before income taxes and loss from equity method investments Provision for (benefit from) income taxes Loss from equity method investments Net income (loss) including non-controlling interests Less: net loss attributable to non-controlling interests, net of tax Net income (loss) attributable to Uber Technologies, Inc. Net income (loss) per share attributable to Uber Technologies, Inc. common stockholders: Basic Diluted Weighted-average shares used to compute net income (loss) per share attributable to common stockholders: Basic Diluted $ 87 $ $ $ Year Ended December 31, 2019 () 13,000 $ 2018 () 10,433 S 4,786 1,516 3,151 1,505 2,082 426 13,466 (3,033) (648) 4,993 1,312 283 (42) 987 (10) 997 $ 443,368 478,999 $ 6,061 2,302 4,626 4,836 3,299 472 21,596 (8,596) (559) 722 (8,433) 45 (34) (8,512) (6) (8,506) S (6.81) $ (6.81) $ 1,248,353 1,248,353 2020 11,139 5,154 1,819 3,583 2,205 2,666 575 16,002 (4,863) (458) (1,625) (6,946) (192) (34) (6,788) (20) (6,768) (3.86) (3.86) 1,752,960 1,752,960 () Our revenue and cost of revenue, exclusive of depreciation and amortization, have been retrospectively adjusted to reflect the implementation of our new accounting policy adopted in the fourth quarter of 2020. Refer to Note 1 - Description of Business and Summary of Significant Accounting Policies for further information on the change in accounting policy. The accompanying notes are an integral part of these consolidated financial statements.

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

1 In order for Uber to break even in 2020 revenues would have to have been 16659 million This is cal... View full answer

Get step-by-step solutions from verified subject matter experts