Question: Your client, Samuel E. Sullivan, is a 67 year-old retiree. Samuel's social security number is 593441777. He lives at 4478 N. Gonzaga Lane in Spokane,

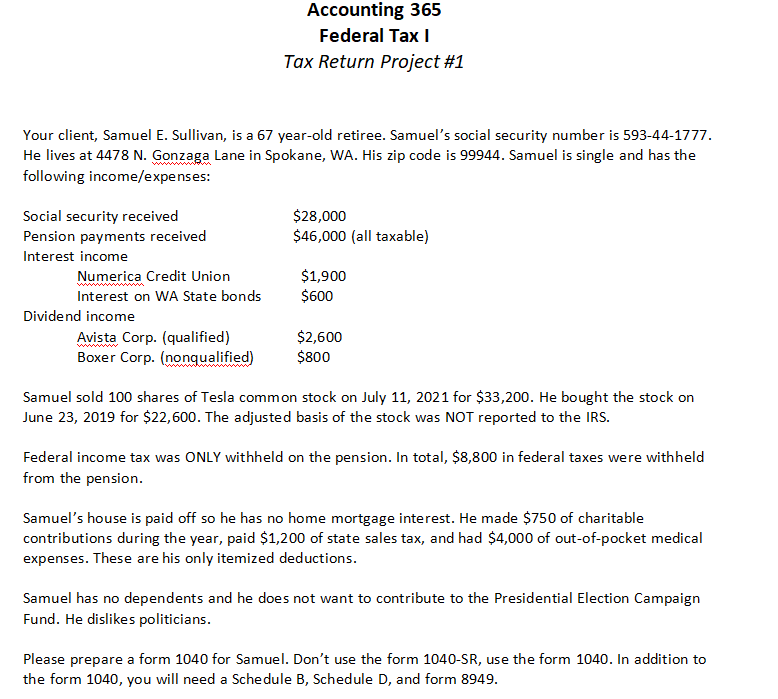

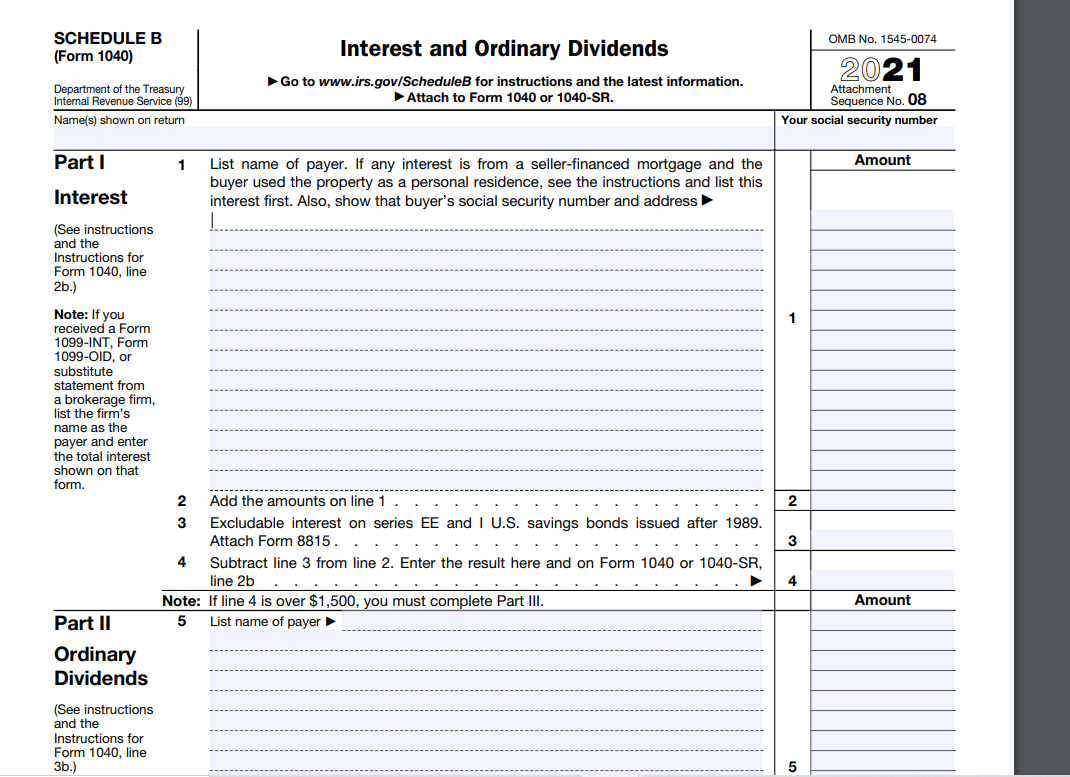

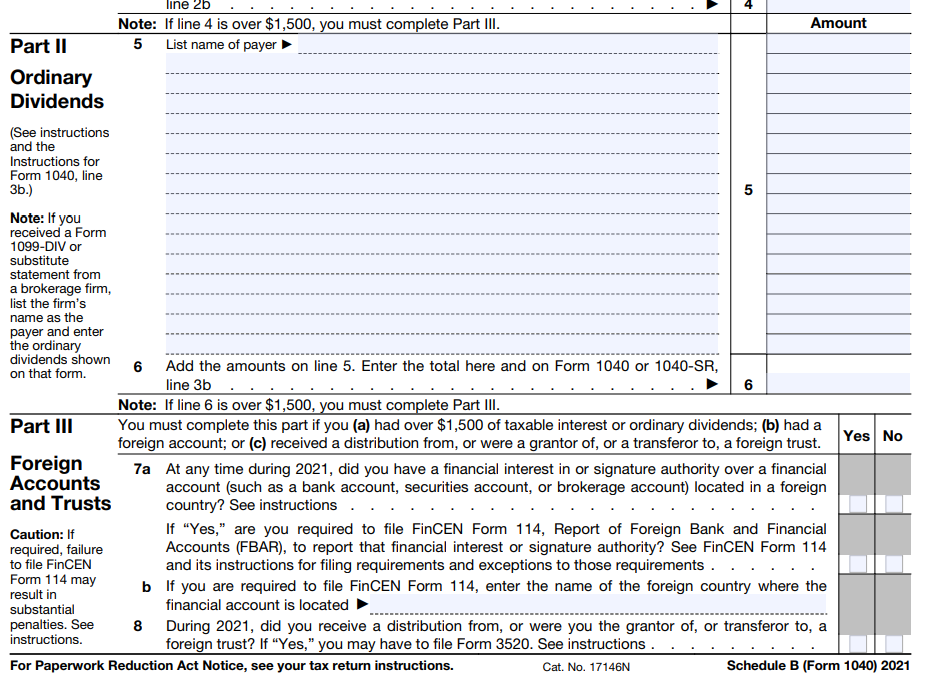

Your client, Samuel E. Sullivan, is a 67 year-old retiree. Samuel's social security number is 593441777. He lives at 4478 N. Gonzaga Lane in Spokane, WA. His zip code is 99944 . Samuel is single and has the following income/expenses: Samuel sold 100 shares of Tesla common stock on July 11, 2021 for $33,200. He bought the stock on June 23, 2019 for $22,600. The adjusted basis of the stock was NOT reported to the IRS. Federal income tax was ONLY withheld on the pension. In total, $8,800 in federal taxes were withheld from the pension. Samuel's house is paid off so he has no home mortgage interest. He made $750 of charitable contributions during the year, paid $1,200 of state sales tax, and had $4,000 of out-of-pocket medical expenses. These are his only itemized deductions. Samuel has no dependents and he does not want to contribute to the Presidential Election Campaign Fund. He dislikes politicians. Please prepare a form 1040 for Samuel. Don't use the form 1040-SR, use the form 1040. In addition to the form 1040, you will need a Schedule B, Schedule D, and form 8949. Your client, Samuel E. Sullivan, is a 67 year-old retiree. Samuel's social security number is 593441777. He lives at 4478 N. Gonzaga Lane in Spokane, WA. His zip code is 99944 . Samuel is single and has the following income/expenses: Samuel sold 100 shares of Tesla common stock on July 11, 2021 for $33,200. He bought the stock on June 23, 2019 for $22,600. The adjusted basis of the stock was NOT reported to the IRS. Federal income tax was ONLY withheld on the pension. In total, $8,800 in federal taxes were withheld from the pension. Samuel's house is paid off so he has no home mortgage interest. He made $750 of charitable contributions during the year, paid $1,200 of state sales tax, and had $4,000 of out-of-pocket medical expenses. These are his only itemized deductions. Samuel has no dependents and he does not want to contribute to the Presidential Election Campaign Fund. He dislikes politicians. Please prepare a form 1040 for Samuel. Don't use the form 1040-SR, use the form 1040. In addition to the form 1040, you will need a Schedule B, Schedule D, and form 8949

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts