Question: Your company is considering a new computer system that will initially cost $1 million. It will save $300,000 per year in inventory and receivables management

Your company is considering a new computer system that will initially cost $1 million. It will save $300,000 per year in inventory and receivables management costs. The system is expected to last for five years and will be depreciated using 3-year MACRS. The system is expected to have a salvage value of $50,000 at the end of year 5. There is no impact on net working capital. The marginal tax rate is 21%. The required return is 8%. Please compute NPV, IRR, profitability index and payback period by filling in all the Xs. Also please provide a capital budget decision for each decision method.

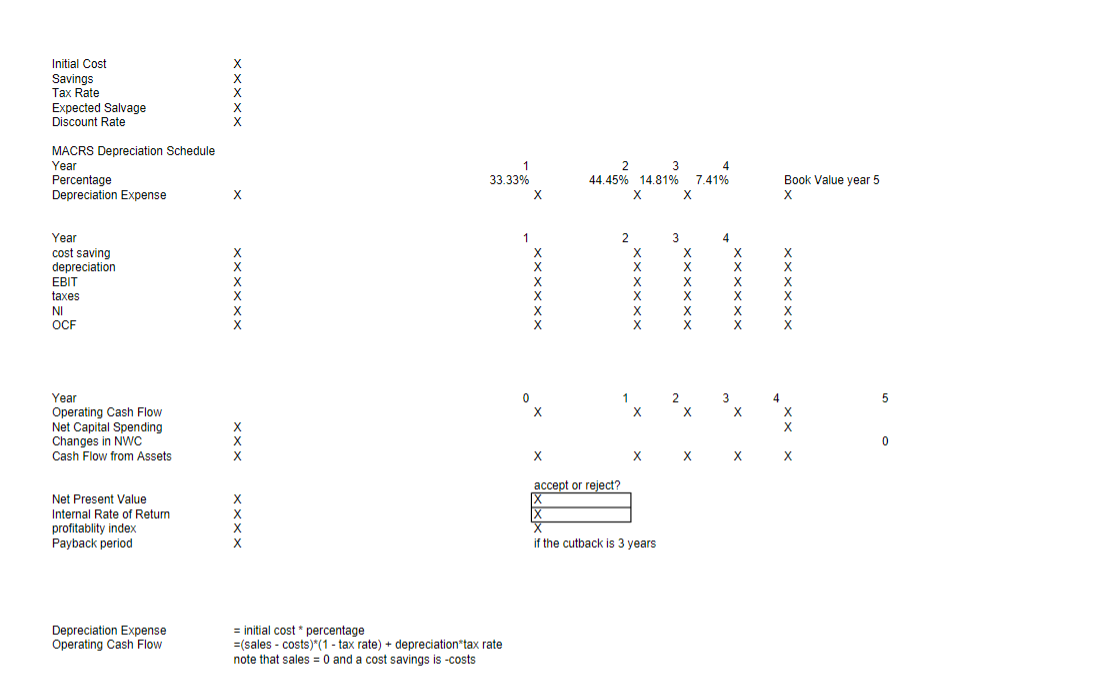

Initial Cost Savings Tax Rate Expected Salvage Discount Rate MACRS Depreciation Schedule Year Percentage Depreciation Expense 33.33% 2 44.45% 14.81% 7.41% X Book Value year 5 X 1 X 2 X X 3 X X 4 X Year cost saving depreciation EBIT taxes NI OCF X X X X X 1 5 0 X 2 X 3 X Year Operating Cash Flow Net Capital Spending Changes in NWC Cash Flow from Assets 4 X X 0 X X X X X X accept or reject? Net Present Value Internal Rate of Retur profitablity index Payback period if the cutback is 3 years Depreciation Expense Operating Cash Flow = initial cost percentage =(sales - costs)*(1 - tax rate) + depreciation tax rate note that sales = 0 and a cost savings is -costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts