Question: Your company is considering a new computer system that will initially cost $1 million. It will save $300,000 per year in inventory and receivables management

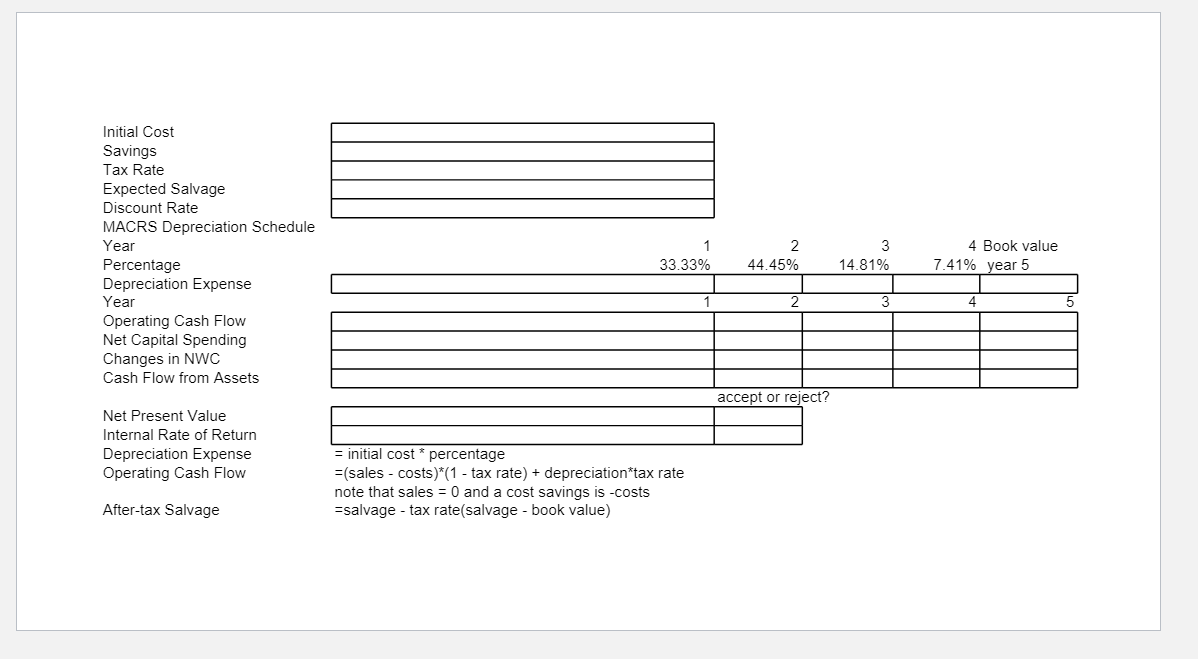

Your company is considering a new computer system that will initially cost $1 million. It will save $300,000 per year in inventory and receivables management costs. The system is expected to last for five years and will be depreciated using 3-year MACRS. The system is expected to have a salvage value of $50,000 at the end of year 5. There is no impact on net working capital. The marginal tax rate is 21%. The required return is 8%. Please work on the Excel worksheet and fill in all the blanks.

Initial Cost Savings Tax Rate Expected Salvage Discount Rate MACRS Depreciation Schedule Year Percentage Depreciation Expense Year Operating Cash Flow Net Capital Spending Changes in NWC Cash Flow from Assets 1 33.33% 2 44.45% 3 14.81% 4 Book value 7.41% year 5 2 3 4 accept or reject? Net Present Value Internal Rate of Return Depreciation Expense Operating Cash Flow = initial cost * percentage =(sales - costs)*(1 - tax rate) + depreciation tax rate note that sales = 0 and a cost savings is -costs =salvage - tax rate(salvage - book value) After-tax Salvage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts