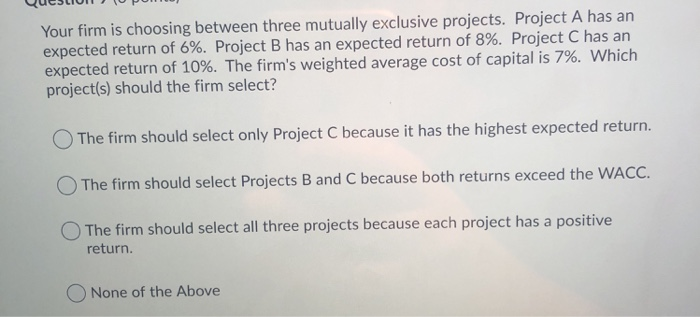

Question: Your firm is choosing between three mutually exclusive projects. Project A has an expected return of 6%. Project B has an expected return of 8%.

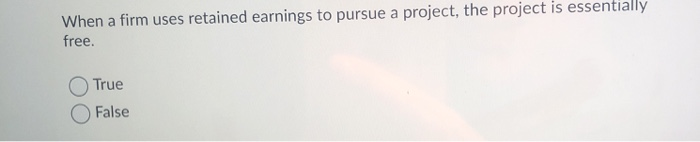

Your firm is choosing between three mutually exclusive projects. Project A has an expected return of 6%. Project B has an expected return of 8%. Project C has an expected return of 10%. The firm's weighted average cost of capital is 7%. Which project(s) should the firm select? The firm should select only Project C because it has the highest expected return. The firm should select Projects B and C because both returns exceed the WACC. The firm should select all three projects because each project has a positive return. None of the Above When a firm uses retained earnings to pursue a project, the project is essentially free. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts