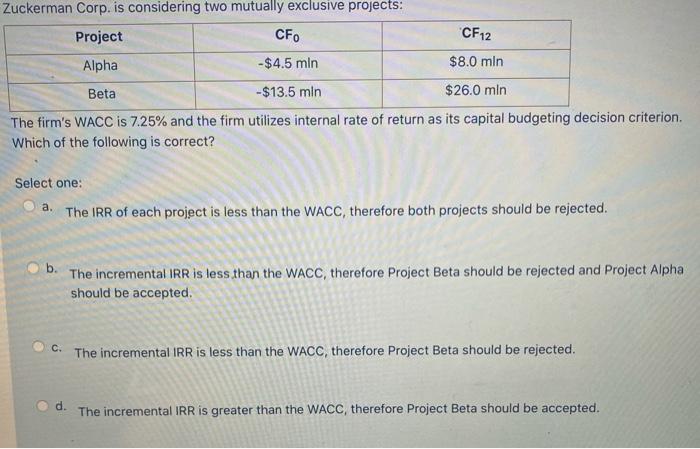

Question: Zuckerman Corp. is considering two mutually exclusive projects: Project CF CF12 Alpha -$4.5 mln $8.0 mln Beta -$13.5 mln $26.0 mln The firm's WACC is

Zuckerman Corp. is considering two mutually exclusive projects: Project CF CF12 Alpha -$4.5 mln $8.0 mln Beta -$13.5 mln $26.0 mln The firm's WACC is 7.25% and the firm utilizes internal rate of return as its capital budgeting decision criterion. Which of the following is correct? Select one: a. The IRR of each project is less than the WACC, therefore both projects should be rejected. b. The incremental IRR is less than the WACC, therefore Project Beta should be rejected and Project Alpha should be accepted c. The incremental IRR is less than the WACC, therefore Project Beta should be rejected. d. The incremental IRR is greater than the WACC, therefore Project Beta should be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts