An investment analyst wishes to explain his clients' rates of return on their portfolios using two variables

Question:

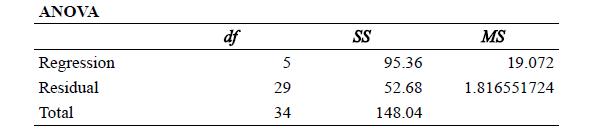

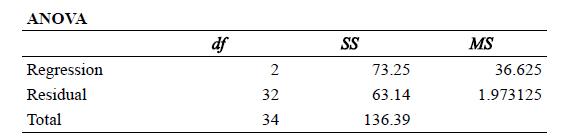

An investment analyst wishes to explain his clients' rates of return on their portfolios using two variables measuring returns from stocks and three from bond mutuals. The results of an unrestricted model are shown here along with a reduced model with just the stock returns.

Based on this information does it appear that at any acceptable alphavalue the bond funds jointly offer explanatory power after controlling for the stocks?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introductory Regression Analysis With Computer Application For Business And Economics

ISBN: 9780415899338

1st Edition

Authors: Allen Webster

Question Posted: