Financial theory holds that there is a direct relationship between the risk associated with an investment and

Question:

Financial theory holds that there is a direct relationship between the risk associated with an investment and the rate of return it generates.

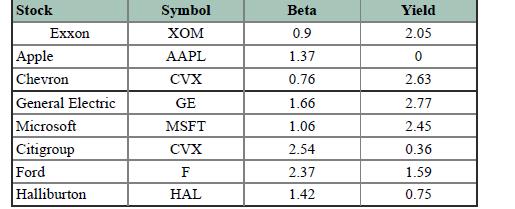

Data for several heavily traded stocks on the organized exchanges are shown in the table. The Beta for a stock is the measure of its non diversifiable risk. It measures the stock's volatility in relation to the market as a whole. The dividend yield is also shown for each investment. These data are taken from the Scott Trade web site,

http://research.scottrade.com/qnr/Public/Stocks/Snapshot?symbol=hal.

a. Prepare a discussion of the results of a regression model treating Yield as the dependent variable. Do the results seem to support the theory? Why or why not?

b. Compute and interpret the standard error of the estimate.

c. Graph the relationship in a scatter diagram. How does it confirm the results of the regression model?

Step by Step Answer:

Introductory Regression Analysis With Computer Application For Business And Economics

ISBN: 9780415899338

1st Edition

Authors: Allen Webster